In case you missed it... Cannabis as a Consumer Staple | The Bengal Bite 🐯

In what should have probably been predictable in hindsight, the U.S. cannabis industry thrived during the COVID pandemic (where it was able to stay open thanks to “essential” designations), recording significant sales growth even in “mature” adult-use markets like Washington and Oregon.

Not many people would have predicted that over a year into a pandemic cannabis sales would be up 30-60%. Maybe that’s because people are focused on looking at what’s new and different about cannabis (and there’s a lot) instead of first looking at how much cannabis behaves like products we know well, we budget for, and buy regularly - consumer staples.

Alcohol, long acknowledged as a consumer staple, saw a very similar pattern to cannabis sales during the pandemic but had the added advantage of being able to sell interstate online:

Consumer staples are widely regarded as recession-resistant - consumers cut discretionary spending first and staples last. Paradoxically, sometimes consumers spend more on consumer staples during a recession by buying more costly products. Marijuana Business Daily research shows this as well - a significant shift in adult-use markets towards more premium-priced dried cannabis.

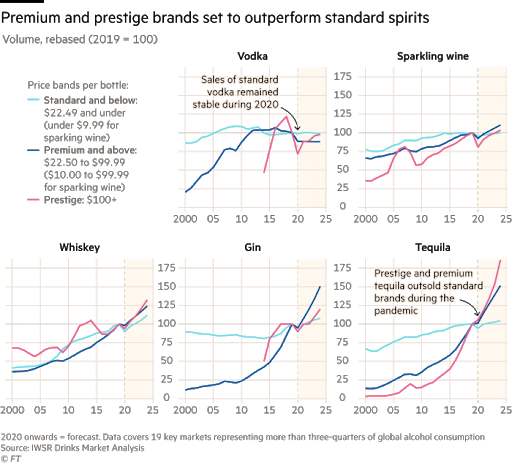

Again, this looks a lot like consumption patterns in alcohol during the pandemic. The Financial Times research showed that premium and prestige brand alcohol spending was up in multiple categories over the last year, often overtaking standard brands’ growth.

Again: cannabis is new and different in many critical ways, but it doesn’t seem to be very different on a fundamental level from other products that consumers make a regular part of their lives (as opposed to a fad or style which comes and goes - I’m looking at you Snuggie).

This Week's Bite:

Don’t forget to factor in taxes: Special purpose acquisition corporations (SPACs) have been a big deal in cannabis financing as of late, but a recent report reminds us that there are downsides to the financial vehicle. Due to Obama-era anti-inversion tax rules, when a Canadian SPAC acquires more than 80% of a U.S. company, any profits that flow up to the Canadian company will be treated as U.S. income. This triggers different tax consequences for U.S. shareholders and foreign shareholders of the cannabis company. (Bloomberg)

One more thing is finally bigger in Texas: Texas, normally a maverick, freedom-loving state, has some of the most restrictive cannabis laws in the United States. The medical cannabis that does exist in the state is basically hemp with a .5% THC cap and only legally available from 3 companies. Fort Worth Republican Rep. Stephanie Klick aims to change that. Her bill would grow the Texas Compassionate Use Program by including patients with any type of cancer, not just terminal, PTSD (only in veterans), and chronic pain that would otherwise be treated with an opioid. The bill would also raise the THC cap 10x to 5%. However, it would take a few more 10x increases after this to allow Texas companies to legally sell even a fairly weak joint. (Dallas News)

Koch turns to weed after Zooming with Snoop: Cannabis legalization has long made strange bedfellows of libertarians and hippy liberals alike, and now the marquee libertarian, Charles Koch, is also joining the fight. It just took the one and only Snoop Dogg to convince him. Americans for Prosperity, the advocacy group co-founded by Koch has joined a coalition of groups that are looking to try and sway the 10-12 necessary Republican votes to pass legalization in the U.S. Senate. (The Hill)

I’ll see you in 3 to 10 hours: A recent meta-study by Australian researchers at the University of Sydney’s Lambert Initiative for Cannabinoid Therapeutics suggests that cannabis impairment can last anywhere between three hours, for inhalable products, to ten hours for edible products based on moderate to high doses. (Ganjapreneur)

Uber delivery for alcohol, food, and weed? (Not really): This week while on CNBC, Uber CEO Dara Khosrowshahi said that they would be open to delivering cannabis when federal regulations change. As we established in last week’s Bite, Biden isn’t budging and more tellingly, Uber made a recent acquisition, alcohol delivery company drizzly, separate from its cannabis counterpart, lantern. Given the need to monetize their network as much as possible, we would not be surprised to see Uber hauling all manner of additional products if federal regulations were to change - from donor organs to livestock. (Marijuana Moment | CNBC)