What Costco Can Teach Us About Cannabis | The Bengal Bite 🐯

Costco is a phenomenal company and a recent episode of Business Breakdowns, a new podcast from Patrick O'Shaughnessy (host of Invest Like The Best, an interview series with investment professionals), took a look at some of the reasons underlying its success:

Maniacal Focus on the Customer: Jim Senegal, one of Costco’s co-founders and the CEO that oversaw much of its early growth, instilled an almost unparalleled focus on the customer and perfecting Costco’s model to increase customer value. This ethos still makes up a significant portion of the company’s DNA.

Leveraging Advantages: 75% of Costco’s operating margin is generally the subscription fees its customers pay. This allows it to run very low gross margins on products and still ultimately be profitable - everything that makes people continue their membership is ultimately a good deal for Costco. The bigger Costco gets, the broader the selection and bigger the discounts - a virtuous circle that tech investors dream about that was happening for decades in large warehouse stores.

Careful Margin Expansion: 25% of Costco’s sales are Kirkland Signature store brand products. Costco has been methodical about giving their customers a quality, budget choice - and with a legitimate focus on the “quality” aspect. Often Kirkland Signature is not the cheapest product Costco offers. Costco has grown its house brand enough to make it the largest standalone brand in America by sales volume.

Highly Considered Product Selection: Costco runs about 4,000 SKUs vs. a typical store’s 40,000. It coordinates deeply with its vendors and, even though it is a hard negotiator, is able to leverage large volumes into significant discounts it passes to customers. Costco also takes months vs. the over year average of most stores to try new products on shelves, allowing it to quickly test demand, apply any information learned, and continue to iterate.

Retail is Detail: A famous saying of Jim’s, it embodies Costcos focus on the little things that provide small, compounding advantages that competitors haven’t matched. Things like forcing suppliers to package in form factors that are shelf-ready and can also be stocked on pallets easily, which allows Costco to utilize more of each stores’ floor space as selling space (vs. a typical Walmart which has 30% of each store as inventory storage), and larger form factors that minimize shrinkage.

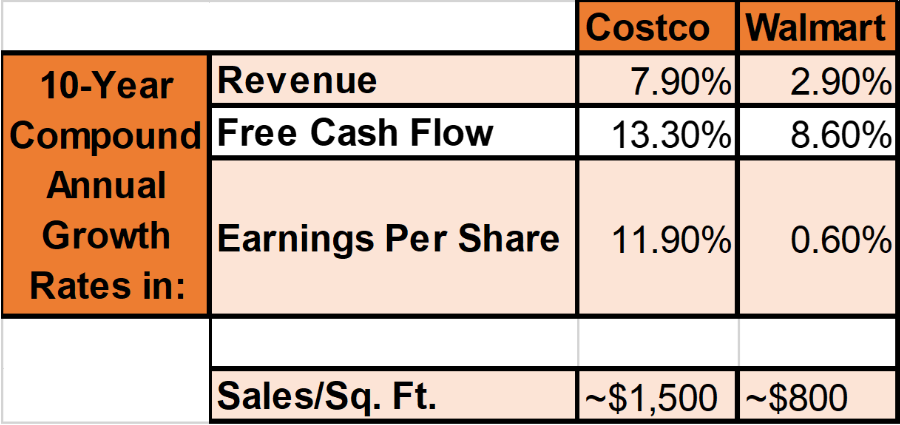

This list should give a flavor of what makes Costco great, but it is certainly not exhaustive. How do these Costco core competencies translate into financial performance vs. competitors? Fairly well:

Source: quickfs.net

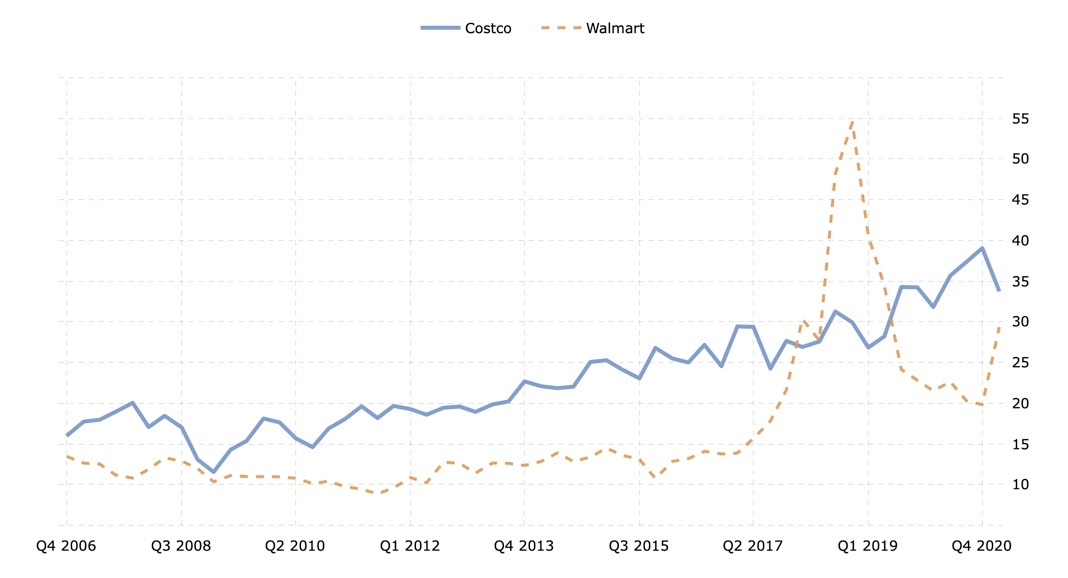

The stock market has generally rewarded Costco with a higher earnings multiple. Below is a graph of Costco vs. Walmart P/E multiples over time:

Source: macrotrends.com

As it relates to our little corner of the investing world, Costco holds some lessons for looking at cannabis companies. Not because MSOs should focus on copying what Costco did by rote - store brands, leveraging discounts, etc., are all tools that have their place but mindless copying is not the point - but because it's important to keep in mind how current US MSO financial results reflect investments for future compounding.

Costco wasn’t always rewarded with a premium multiple. For much of its earlier history, many observers did not quite understand its advantages and how it was compounding them. Costco would build 20-30 stores per year, with an initial capital expenditure on the building, merchandise, etc. for a new store costing tens of millions of dollars (about $100m is what it costs today). But each store by itself only contributes 3-8% in margin, with about a 10% free cash flow yield on the initial invested capital. In most years, because of the expansion, Costco wouldn’t show much in the way of earnings or EBITDA at all. But the additional stores led to more buying power, which led to better value for customers, which led to more memberships, which led to a compounding machine that only became obvious to everyone years later. While it’s more difficult for investors to see, coming to an accurate conclusion about whether an MSO is wisely investing into becoming a platform for compounding value, like Costco, is likely much more important than tracking whether a company met or beat analysts’ quarterly EBITDA estimates.

Again, US MSOs shouldn’t copy Costco’s business by rote, but should look at the underlying themes and reasoning for hints as to what could help them build value in their markets. Except for $1.50 hot dogs, which the MSOs should mindlessly copy immediately.

This Week's Bite:

There be deals in these hills: A sleeper-mega market, the $900m in sales Pennsylvania medical marijuana market is second in size only to Florida. In this past year, PA has been a hotbed of cannabis deal activity with over $400m in mergers and acquisitions, oftentimes by out-of-state MSOs looking to enter the lucrative market or in-state operators looking to consolidate their footprint. (Marijuana Business Daily)

Holistic’s $55m fundraising haul: One of Bengal’s portfolio companies, Holistic Industries, recently completed an oversubscribed fundraising round that was initially targeted at $30m. The company, which has successfully doubled YoY, is looking to deploy the funds to continue to organically expand its existing infrastructure and license portfolio, and also to pursue M&A opportunities when relevant. (New Cannabis Ventures)

Harvest and Trulieve announce mega-merger: This past Monday, representatives from the two publicly traded companies announced the $2.1b deal to form a new industry leader in the cannabis space. The newly announced company would have combined business operations in 11 states, with market-leading positions in both Arizona and Florida. As outlined, every Harvest shareholder will currently receive .117 Trulieve shares at the close of the transaction, subject to certain adjustments if there are interim financings or certain other events prior to close. (Barron's)

New meaning to runners high: Despite the so-called common wisdom that people who enjoy weed, or “stoners,” are couch potatoes, a recent study shows that cannabis consumers are actually on average more physically active than non-users. “The study indicated that light marijuana use is not associated with a statistically significant difference in time being physically active, [however] those who infrequently use cannabis were more likely to self-report more moderate physical activity compared to non-users.” No wonder some sports organizations seem to no longer be preoccupying themselves with cannabis. (Marijuana Moment)