The Bengal Bite 🐯 | Rising Tide of Legalization | January 8, 2020

With the certification of President-Elect Biden’s win and the Georgia runoffs concluded, the 2020 elections are finally over. The last election of the cycle ended with two Democratic victories, giving the party control of both chambers of Congress to go along with their control of the White House, portending a continued and accelerated “rising tide of legalization.” The Senate will be led by Chuck Schumer (D-NY), who himself has been a forceful advocate for legalization, making it more likely the legislature will take up cannabis liberalization -- be it the MORE Act, which would deschedule cannabis on the federal level, or the STATES Act, which would allow states to take their own path on cannabis legalization.

This week's Bite:

Institutions at the gate: Many of the largest investors have stayed away from cannabis, but potential federal legislation might be a catalyst for change. (Jefferies)

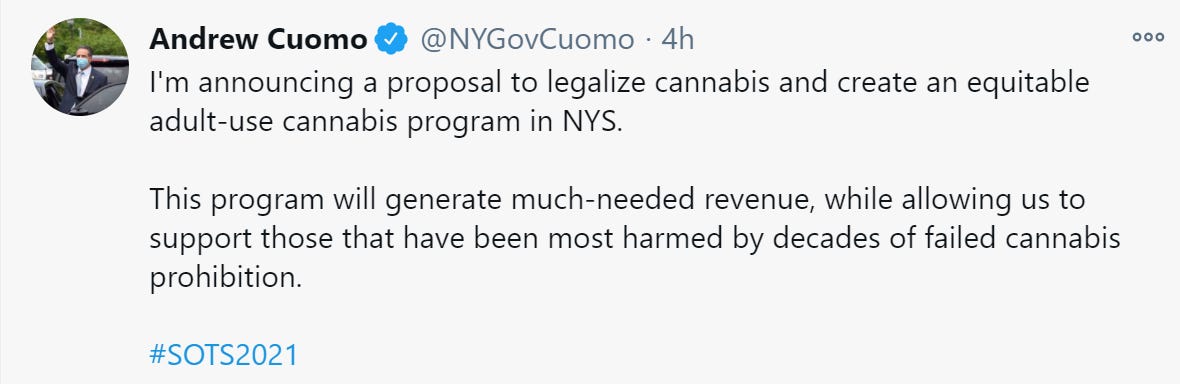

Dominoes start to fall: New York Governor Andrew Cuomo announces intent to pursue cannabis legalization in next legislative session. (Twitter)

Increased optionality: With control of the Senate Democrats have multiple avenues to enact national legalization of cannabis. (Benzinga)

Read more below:

GA runoff: Boost for near term US policy and possible institutional investment

For a variety of reasons, institutions are unable to invest in cannabis stocks. Jefferies analyst Owen Bennet outlines why this is the case and the implications of any future federal legalization: “1) Some institutions can't invest in US names as not on a major exchange; 2) Even if the exchange is not a factor, other institutions can't invest in US names as clearing houses won't settle the trades (could be prosecuted for money laundering); 3) Even if 1) or 2) were not an issue, others still won't due to being federally illegal and concerns over reputation//prosecution themselves. Any of the MFO, MORE or STATES Act would likely result in allowing US names to list on a major exchange, clearing houses would settle trades, investment bank/capital market support would open up, funds would be able to invest without fears of prosecution, and Canadian names could enter US THC.”

Dominoes are starting to fall following New Jersey’s cannabis legalization this past November. New York Governor Andrew Cuomo tweeted the following earlier this week:

What a Democratic victory in Georgia's runoff election means for the stock market

“We go from speculating what President-elect Biden could have done for cannabis reform via Executive Order (or by directives/’memos’ from his incoming Attorney General) and if the Senate would have held a vote on the SAFE act (banking reform) would have even taken a vote, to a new world, in which the question is more about the timing and scope of much broader reform for the cannabis industry,” said Cantor Fitzgerald analyst Pablo Zuanic.