Rescheduling and how Cannabis is Different from Alcohol

Some thoughts from Bengal Capital heading into the weekend

Rescheduling

As many of you undoubtedly have seen, the Department of Health and Human Services (HHS) has recently recommended that cannabis be rescheduled from Schedule I to Schedule III, a lower risk classification.

CNN covers the basics here, a more in-depth discussion by friend of Bengal Marc Hauser of Hauser Advisory (and writer of

) is here, and a panel discussion featuring Marc, (also friend of Bengal) Aaron Edelheit of and two practicing attorneys with deep expertise in rescheduling (including one former FDA commissioner) is here.The ball is now in the court of the DEA to make a final rescheduling determination - some speculate that this could come within 90 days, but others are much more skeptical and envision a longer process. Uncertainty remains as to the DEA’s final recommendation, not least of which because of international treaty obligations which facially seem to require cannabis be Schedule II at a minimum. So far, the market has seen the news as a resounding positive - MSOS 0.00%↑ (our rough US cannabis benchmark) is up just under 70% from trough pricing on the news as of this writing.

There is even more uncertainty as to what a move to Schedule III would change on a business level. Significant social media commentary by investors in the space suggested that Section 280E (i.e., cannabis businesses’ inability to deduct below the line expenses not included in COGS from taxable income) would no longer apply if cannabis is below Schedule II (and this seems to be correct based on our reading of 280E), and that the mechanics of rescheduling would not bring an accompanying federal cannabis excise tax which would potentially negate any savings realized by cannabis businesses.

How long any such 280E-free world would last is unclear, as is whether it would really make a difference on a day to day business level as the price compression cat is out of the proverbial bag - expanding margins will just allow additional price competition (what we prefer to refer to as price normalization). Our experience has been that tax changes most of all tend to benefit consumers in the form of reduced prices.

We could certainly see some companies taking advantage of the situation’s momentum in order to raise equity and/or refinance debt. But many large MSOs have, in our view, fundamental operations problems that a move to Schedule III won’t solve, and recent Q2 2023 financial results did nothing to allay those concerns. If a rising tide lifts all boats, why not just invest in the ones that aren’t leaking in the first place?

What Will The Future Cannabis Market Look Like?

Recently,

published a piece that argued that post legalization the cannabis market in the US will be “hourglass shaped” in that a “handful of producers owned by multinational alcohol, tobacco and [CPG] companies will make up the vast majority of national distribution and sales volume” while “countless” smaller companies create more craft/specialized product for connoisseurs.We respectfully disagree that the “vast majority” of sales will be taken by a handful of companies - we think Cannabis Musings is giving slightly short shrift to the commercial wherewithal of the “countless” smaller players ability to take significant volumes from larger ones.

To be clear: While we disagree with this particular musing, we think Marc’s thoughts at

are very worthwhile for cannabis investors and encourage our readers to follow him as well. A debate like this is one worth having and someone like Marc, who approaches the industry with a depth of experience and thoughtfulness, is someone worth having it with.We describe our reasoning in more detail below.

Why Is A Soap Bubble Round?

Alcohol is generally a good analogy for cannabis except for places in which it breaks down significantly. To start with, production of alcohol often has significant scale benefits where a very large producer is able to achieve significant unit savings which make a large difference in their competitiveness. For indoor cannabis (which consumers have generally found to be non-interchangeable with outdoor or greenhouse flower in terms of quality), we have found that scale does not bring significant advantages in unit costs beyond a certain (relatively low) point, and that larger scale can just as often lead to more problems with quality control. So one of the key advantages that large producers have in alcohol, which in turn supports the existing “hourglass” structure of the alcohol market, would be negated.

Distribution of alcohol has even more significant scale benefits than production. A large producer will already have a very well-developed network of sales and distribution out of necessity. Given alcohol’s low value to weight and its often need for refrigeration, it is exceedingly costly to use existing shipping services to distribute alcohol to intermediaries like bars, stores, etc. Cannabis has a much higher value per unit of weight as a finished good, so it could relatively easily use existing distribution networks once that is allowed under legalization. Why create the Amazon Prime of cannabis when you can just use UPS with a Boveda pack to maintain moisture? Cannabis as a bulk material could be relatively easily shipped using existing trucking firms like an agricultural product. Economies of scale in sales are also enormous because there are such a wide variety of alcohol purchasers (bars, small specialty stores, large chains, restaurants, etc.) which all need attention - the exact opposite of the current status quo of cannabis only being sold to consumers through dedicated cannabis stores. We anticipate that dedicated cannabis-only retailers will be more or less standard long beyond legalization.

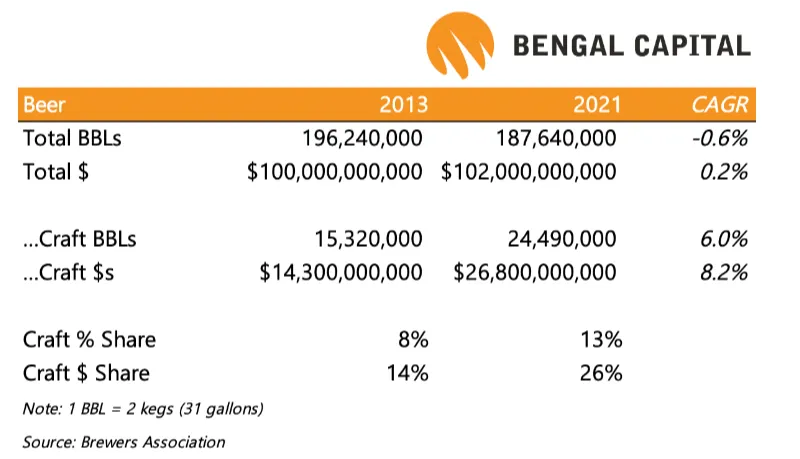

Ultimately, a large part of alcohol’s structure is also based on the three tier system, which defines post-Prohibition alcohol regulation in the US. It is telling to look at what happens when the three tier system has been relaxed and how consumers have responded - particularly as it comes to craft breweries. It was only a relatively short time ago that some states allowed smaller breweries to have attached tasting rooms (i.e. bars) in which they were able to sell the beer they brewed at full “retail” prices. That regulatory change led to a fundamental change in the economic viability of craft breweries, which ultimately led to a flowering of craft breweries that helped usher in a significant change in consumer tastes (see a chart we previously put together of craft beer sales growth for this piece below).

Craft breweries are instructive not because small cannabis producers will get tasting rooms in the future, but because they show what happens when the underlying economics of alcohol change significantly - suddenly the market isn’t as hourglass shaped as it was before. Cannabis does not have to go through the craft brewery phase of discovery - the economics of cannabis are already different enough from alcohol that the incentives to create an hourglass market structure are significantly diminished.

This discussion focuses generally on flower, which makes up 50% or more of even mature adult use markets with well developed extract/concentrate products. There are more economies of scale in edible and extract production than in flower production in our experience, but whether those economies will be material - i.e. we have our doubts as to whether the economies of scale are so significant that they destroy or significantly impair smaller scale producers ability to compete and win share. And, even with production economies, it is still difficult to see significant distribution economies like in alcohol.

In our minds, this reality doesn’t change even with significant retail verticalization. As markets mature, consumers have demonstrated a preference for variety and novelty which is very difficult for one company to supply - we just don’t see a few companies owning nearly as much of the shelf as they do in alcohol. Industry commentators sometimes throw out the phrase “Trader Joe’s” as a metaphor for a verticalized retailer which can provide all of their customers’ wants and needs without realizing that Trader Joe’s works so well because they don’t produce anything but instead do an incredible job speccing, sourcing, and acquiring products that delight their customers - behind every Trader Joe’s shelf is a legion of suppliers. The future we see is a much more fractured market, with significant industry sales in the hands of regional champions and craft brands.

So why is a soap bubble round? Because that’s its most energy efficient configuration - and an hourglass simply isn’t efficient enough for cannabis.

A Note On Grown Rogue

Recently, Aaron of

chose to convert $1.5mm of convertible debt he held in Grown Rogue ($GRIN on the CSE / $GRUSF on the OTC) which matured in December 2025. He was under no contractual obligation to convert early, and Grown Rogue’s stock isn’t nearly liquid enough for him to plausibly sell his CAD$0.20 converted stock at current market prices of ~CAD$0.30 and quickly take a profit. His early conversion saves the company over $300,000 in interest. Rather, this is a move driven by a willingness to be a forward-thinking long term capital partner to a terrific business. We are happy to invest in Grown Rogue alongside shareholders like him.