The following letter was sent to investors in the Bengal Catalyst Fund, LP yesterday.

Dear Investor,

The Bengal Catalyst Fund, LP’s (the “Fund”) performance (preliminary, net of fees, and unaudited) is presented below alongside that of MSOS, a US cannabis-focused ETF. We do not consider MSOS a benchmark, but we do believe it is the closest equity market proxy for the US cannabis industry, so we view it as a reasonable indicator of cannabis investor sentiment.

We are, of course, happy with the Fund’s performance in 2023. With the industry backdrop of improving sentiment (MSOS up ~47% YTD), our Fund continues to perform well in early 2024 as well - as of this writing, the Fund is now solidly in the green since inception vs. MSOS -75%.

We want to start this note by addressing an important juxtaposition, as we’ve recently had a few folks describe us as bearish. Just as when we started our Fund in 2021, we remain excited about the underlying growth and the vast opportunity set and total addressable market presented by the cannabis industry. We believe our underlying concerns mainly with respect to the (1) core operating capabilities and (2) capital allocation strategy of many of the larger, more visible companies in the sector are a large reason we’ve been able to preserve capital in what’s been a miserable investment environment for cannabis equities.

We prioritize people and capabilities over assets, albeit with a deep understanding and experience base within the individual markets and the respective asset values. We continue to see fantastic opportunities to deploy capital in the cannabis space. Although we don’t actively fundraise, we welcome new limited partners that are aligned with our approach and we believe we’re well positioned to generate strong long-term returns with our highly concentrated, fundamentally-driven and actively engaged investment strategy.

A few reminders:

Your results may vary from those above depending on time of investment

The above figures do not include the results of any side pockets

We expect our returns to be volatile given the illiquidity and concentration of the Fund’s portfolio. Regarding the last point, we fully expect that there will be periods in which we underperform the broader cannabis equity market as we seek to generate sustainably better longer term returns.

Your individual account statements should be available soon at the current fund administrator’s (Panoptic) investor portal; we are finalizing some information on the side pocket investments as a last step. Please reach out to us if you need help accessing them.

As is our usual practice, we are sharing some thoughts regarding the cannabis investment environment below as well.

Bengal Commentary - Q4/FY 2023

Ants vs. Locusts

Introduction

Because this letter is longer than last year’s, a roadmap:

Introduction: Our brief thoughts on the current rescheduling process

Portfolio Review: a review which cover’s the fund’s holdings (all four of them!) and includes our thoughts on their valuations.

Bad Companies: a broader commentary on why we believe many large MSOs are fundamentally bad businesses - a reality which even rescheduling to Schedule III would not change - framed by the metaphor of seeing well operated companies (ala Grown Rogue) like ants carefully building a colony that endures while the larger MSOs are more often locust swarms that strip vegetation before moving on.

Opportunities We Currently See: some brief comments on where we do continue to see potential value in the cannabis investing landscape.

A View of the Likely Future: a rough sketch of what the future looks like for large cannabis companies.

Conclusion: Parting thoughts.

Note that even where it is unspecified, readers should understand any statement of belief to be as of the approximate date of the writing of this letter in January and early February 2024.

But First, a Message from the DEA

As with most of our letters, we find ourselves starting again with political type musings. Instead of SAFE Banking, the latest “catalyst” is the perceived likely rescheduling of cannabis by the DEA from Schedule I to Schedule III as recommended by HHS (and as we wrote about in a previous Bengal Bite). The most potent consequence of such a move would be removing cannabis companies from the ambit of IRS Section 280E, which broadly disallows cannabis companies from taking many normal business deductions for overhead costs. This would boost cannabis company profits, especially those with significant retail store costs, at least temporarily.

Internally, the Bengal team believes Schedule III is likely, although there is some disagreement as to how likely - one Bengal partner thinks the odds are 95% by the end of 2025 while another thinks those odds are closer to 70%. On timeline, the Bengal team generally doesn’t put much stock into theories that match timing of rescheduling to President Biden’s reelection - these types of predictions have pretty much uniformly been wrong before. Cannabis liberalization is widely supported in surveys, but it generally seems to only be an important issue to 18-25 year olds - the cohort least likely to vote - and the Biden team undoubtedly knows this. The DEA rescheduling process is much more bureaucratic than democratic at this point and any lineup with election milestones is more than likely to be just random.

Portfolio Review

Before we jump into our thoughts on the broader cannabis markets, some thoughts on our current portfolio. We continue to like what we own and believe all of our holdings continue to have significant upside, albeit strategies for realizing that upside may differ. As a general portfolio-wide metric, we believe our portfolio is still trading at or slightly below 50% of what we think a conservative estimate of fair value is. Accordingly, we believe there is still significant growth in the portfolio as it is.

With that said, we include some specific thoughts on our holdings and their respective valuations below.

Grown Rogue (OTC:GRUSF, CSE:GRIN)

As the largest position in our portfolio, Grown Rogue’s price appreciation has also driven the majority of our performance. We continue to believe Grown Rogue still has a long runway of profitable, capital-efficient growth, and therefore believe it continues to be undervalued despite its ~160% price appreciation in 2023 (CAD$0.145 to CAD$0.38, and currently trading north of CAD$0.40).

We are especially excited by its recent expansion into New Jersey, which we believe will be an opportunity for Grown Rogue to continue to demonstrate its adroitness at implementing its strategy: land in a market with an efficient, right-sized craft grow, provide an almost always undersupplied product in early markets (true craft quality flower), take advantage of higher initial prices - while still prioritizing value and delight to the customer - to have significant capital returns in the early years, and as prices come down be left with a business that sustains strong capital returns - much like they already do in Michigan and Oregon.

Critically different from many large MSOs, as discussed in more detail below, the success of this strategy is not dependent solely on high prices and creates enduring value by continuing to provide a quality product at an approachable price to consumers even after prices have fallen. So, while we believe Grown Rogue will benefit from higher initial pricing, we do not think it depends on those prices staying elevated in order to make a profit. Instead, we believe that in a normalized, mature New Jersey, Grown Rogue’s facility will still make more than adequate returns on capital - much like its facilities in Oregon and Michigan already do. We estimate that if price compression turns New Jersey into Oregon, Grown Rogue will continue to be able to produce greater than 20% returns on its invested capital - a number we are more than happy with.

The embedded optionality of this model is that it stands a much higher chance in our view of creating enduring brand value and having Grown Rogue be trusted by consumers as a source of value in the future than most other strategies seen today in cannabis. Grown Rogue using its base in the Oregon Rogue Valley to be a future center of excellence in craft quality outdoor cultivation in interstate commerce is another source of optionality in our minds, albeit one that’s difficult to put tangible value on today.

Grown Rogue has recently announced that it will be investing in some retail stores in New Jersey as well - something we support strategically and have put some capital behind given the importance of aligned retail in MSO-heavy markets (what we casually refer to as “cartel markets” in the early days). We believe Grown Rogue is structuring this with a strong local partner and in a way to avoid management attention drift from their primary craft cultivation focus.

Grown Rogue pre-announced its Q4 2023 for the quarter ended October 31, 2023 (Grown Rogue has thankfully just announced that they will be transitioning to standard calendar financial reporting periods soon). Its existing markets of Michigan and Oregon continue to perform well, particularly when considering Grown Rogue is a wholesaler in price-normalized markets - Michigan has seen a significant jump in revenue and aEBITDA driven by Grown Rogue’s further inroads into higher priced pre-packaged products and Oregon saw a modest rise in revenue with a modest fall in profitability (we are okay with using aEBITDA as shorthand for profitability here because the normalized cashflow numbers do not tell a different story here like they do at many larger MSOs). Fluctuations like those in Oregon are to be expected in mature markets - margins are still well above any range that would cause us concern. We also believe the higher-margin services revenues from Grown Rogue’s consulting relationship with Goodness Growth are an added bonus, especially as 2025 lines up to be the year Minnesota adult use goes live.

A few more notes on performance/valuation:

Corporate Overhead: Corporate overhead expenses as a percentage of aEBITDA (a measure in our minds of corporate efficiency) modestly ticked up - whereas before corporate “cost” the company about 10% of aEBITDA, it now costs about 18%. In absolute terms, the number is still reasonable, and some increase was always expected due to Grown Rogue’s expansion into new markets without the corresponding revenue yet in those markets. In the future we expect corporate overhead as a percentage of aEBITDA to trim back down as the company shows operating leverage in its new businesses.

Valuation: Note that we do not see the point in being as precise as many analysts in the space since history has proven precision is certainly not accuracy in cannabis, so our estimates are necessarily rough. We focus on being fundamentally right on major undervaluing rather than guessing specific future numbers. With that said, Grown Rogue currently trades at about 9-10x trailing 12 month (TTM) aEBITDA and 6-7x runrate EBITDA. Runrate aEBITDA is not as useful here because it does not include New Jersey, which is rapidly being constructed right now, as well as not accounting for a lesser, but still important, likely boost from Grown Rogue’s consulting agreement with Goodness Growth, especially as Minnesota opens adult use in 2025.When estimating New Jersey, our conservative case strives to be realistically pessimistic (if that makes sense?) short of assuming an asteroid is going to hit the earth. So, for example, for our conservative Grown Rogue New Jersey internal estimates we assume: (1) only two months of sellable harvests in FY2024 and then yields significantly below existing Oregon/Michigan facilities going forward, (2) significant price compression in New Jersey over the next two years, (3) more inflated costs per pound in New Jersey than in Oregon/Michigan, etc. With these conservative assumptions, we see Grown Rogue’s New Jersey operation adding a modest $1mm in aEBITDA in FY2024 and an additional $4mm in FY2025 with significant room to outperform these estimates. Even these low estimates mean a lot to a company of Grown Rogue’s current size.Taking all of that together, we believe that Grown Rogue conservatively trades at under 4x 2025 aEBITDA (assuming conversion of their now in-the-money convertible debt - without such conversion they would be trading at closer to 3x 2025 aEBITDA).

Quality: As of this writing, large MSOs trade at ~7x estimated 2025 aEBITDA while even the smaller publicly traded names trade around ~5x. Given what we think Grown Rogue will do, we believe it trades at an unjustified discount to average multiples while being a higher quality company - it is much easier to project forward Grown Rogue’s earnings power with confidence, coupled with earned credibility for a more disciplined capital allocation strategy.

With large MSOs, often the investing decision seems to be made by many in spite of management and other shareholders - investors seem to believe the businesses are so good or likely to appreciate so much that they hold their noses as they click buy. Not so with Grown Rogue, which continues to have an engaged and aligned management team led by CEO, Obie Strickler - a man who has not too long ago put cold hard cash into the company alongside Bengal. As the old adage goes: insiders sell their stock for many reasons but they usually only buy for one. Recently the management team was augmented by a former colleague of a few Bengal partners - a whip smart young executive who we are excited to have helping Obie and his team. In addition to management, Grown Rogue has a terrific shareholder base (even excepting yours truly) - we want to again highlight, Aaron Edelheit at Mindset Value for being a committed long term partner by voluntarily converting $1.5mm of convertible debt (and allowing the company to save over $300,000 in future interest) to put the company on even more solid footing.

We believe that Grown Rogue’s best days are still ahead - and that businesses with their peak in the future should be worth more today than businesses which are on a downslope. Again, we do not see the point in being needlessly precise but we believe that with reasonable assumptions Grown Rogue remains materially undervalued. As of this writing, we believe a conservative fair value per share only starts in the range of CAD$1.00 - an almost 100% bump from its price as of this writing - and can easily see a case for over CAD$2.00. We continue to be excited by the prospects ahead of this great company.

Body and Mind (OTC:BMMJ, CSE:BAMM)

Body and Mind (BaM) is a significantly different company from where it started the year because it has smartly divested assets to get away from toxic leverage. Over the course of 2023, it became apparent that BaM’s senior lender was not particularly collaborative nor forward looking, which meant that the company had to prioritize debt repayment so it could unlock further value. By selling its Ohio assets, BaM was able to do just that - its secured lender was fully repaid ~$7.3mm in October 2023.

A broader picture of where BaM is now:

Nevada: BaM recently announced that it had reached a definitive agreement to sell its Nevada operations for US$2mm in cash and promissory notes, which will then be used to finish construction of its Lynwood and Lawrenceville dispensaries. While we think highly of BaM’s scrappy cultivation skill, we believe this is the best use of the company’s capital.

Illinois: BaM has opened and is steadily increasing sales at its retail location in Markham, and has attained approval and begun tenant improvements at its future border store in Lynwood. We believe that their border store is especially well placed and has significant profit potential.

New Jersey: BaM previously announced its New Jersey retail license in Lawrenceville, New Jersey was approved, and now the Nevada divestiture above should provide the necessary capital to complete construction. Again, we believe this location has significant profit potential because of its solid retail “bones” - a 4,100 square foot building with easy access off of a major throughway and over 150 parking spots. Recall that Bengal partners individually owned 2/3rds of this store and sold it to BaM for just over 10mm shares (approximately US$1.5mm in consideration at the time and less today) which were all tied to various performance targets (in addition to de minimis reimbursement for cash expenses such as transaction fees).

Ohio: In addition to its sold retail license, BaM executed a definitive agreement to sell its Ohio processing license for US$2mm, which will be used to fund buildouts of the Illinois and New Jersey stores and fund overhead expenses.

Arkansas: BaM continues to hold an interest in a vertically integrated medical dispensary in West Memphis, Arkansas. True to its name, West Memphis is actually a very short drive across the river from real (no offense) Memphis, Tennessee. We believe the long term profit potential of this store makes it a potential acquisition target for other operators in the area.

California: BaM continues to operate three stores in California (owning two and having a 60% ownership interest in one). It is a difficult market and we believe the stores operate at roughly break even on a cash basis or a little better - a looming move to Schedule III should turn these stores into likely cash producers.

One of the first things we think about in all companies, and BaM is no exception, is how we are protected on the downside. With BaM, when we took the position we felt reasonably comfortable that the company was trading below the value it would fetch in an orderly liquidation. To be clear, this was not and is not how we think about how much BaM is worth - it is more a way of us saying “Well, realistically, it seems tough for it to be worth less than X but it could be worth much more.”

Our initial estimate for the liquidation value of BaM was likely overly optimistic as cannabis capital markets proceeded to crash and likely buyers now found themselves with much less access to reasonably priced capital. But, even with the much more constrained capital environment, our back of the envelope valuation for BaM’s asset base is still easily north of $20mm compared to its current enterprise value of (using our slightly modified internal numbers) ~$16-17mm.

There is always the chance that a strategic acquirer with exposure in Illinois and New Jersey makes a bid for BaM - the likely strategic value of just those assets alone to a company with major wholesale operations in both states is significant. One prospect that makes us a bit nervous is an all stock offer by a company whose equity we don’t have as much faith in, but that is a fundamental risk of public markets.

Still, we believe BaM’s actual value will more likely be determined not by how much shareholders get when it’s parted out, but about efficiently utilizing the assets that are there and leaning into the operational core competencies that exist within the company but are still unappreciated by the larger market. In particular, we see potential for BaM to follow a Grown Rogue-like strategy by pairing its Illinois and New Jersey retail assets with small grows that inherit its Nevada grow’s scrappiness. We believe management and the board are aligned with our goals of value creation for all.

XS Financial (OTC:XSHLF, CSE:XSF)

XS Financial’s business, we believe, has performed well. A simplified overview: XS provides a form of financing to cannabis operators centered around equipment leasing. If MSO A needs to expand in State Y, it can find sale leaseback financing to fund the facility buildout, but often needs additional money to fund the purchases of equipment necessary to make the facility actually run - extraction units, packaging machines, lights, etc. XS provides financing for the latter type of capex spending, usually loaning some portion of the purchase price to MSO A in a fully amortizing lease that is paid off in under five years. XS’ current portfolio yield on its leases is around 14.6%.

Critically, the past year has shown something we thought to be true about the business when we invested: it is very safe relative to most cannabis lending. Thus far there have been zero defaults in XS’ portfolio even as a few of its borrowers have gone through receivership (e.g., Parallel and Skymint) - a credit to its team and forethought in structuring its arrangements.

A lender like XS depends on a few different things to generate returns. One of those is increasing how much money it lends in order to better spread the costs of its internal underwriting/due diligence/sales teams. On this score the last year has not been as good since lending was understandably pulled back from the space. Despite this, we believe the long run future of XS’ niche is bright - we believe this is a form of financing that will continue to be utilized as additional states come online (e.g. New York, Georgia, Alabama, Ohio, etc.) and that opportunities exist for XS team to utilize their skill base to make similar loans outside of cannabis at still favorable risk adjusted rates. They have proven to be a very adept lending team - indeed, a catalyst for our original investment was our confidence in the leadership team. That said, the equity markets have been particularly unkind to XS, leaving them in a position of being modestly subscale despite their disciplined and successful loan book.

XS has a convertible debt maturity looming in June 2024 and we have confidence that the team will manage this well. We are confident that at least some investors, such as Bengal, will also be interested in ways of continuing to remain capital providers to the company - either by finding an arrangement to extend their portion of the convertible debt or other avenues.

The equity is thinly traded at best so price discovery cannot be taken for granted. As of this writing, the last quoted price on the CSE was CAD$0.045 per share, implying a value for the equity of less than CAD$5mm. We are not sure what the value of it ultimately is but we are confident that it is north of that. We believe that the “acquihire” value of a team which has done the work that XS has done in such a challenging industry is alone worth north of the current price, even leaving aside any value of its still default-less residual portfolio of loans.

We expect to update you soon as XS addresses the upcoming debt maturity.

Goodness Growth (OTC:GDNSF, CSE:GDNS)

Bengal partner Josh Rosen continues in his role as interim CEO. We withhold broad comments given his insider status and the ongoing litigation with Verano due to their failed merger. That said, we will note that the company’s assets in Maryland flipping to adult use enabled them to produce positive cashflow from operations in Q3 2023, and we believe that they are well positioned to service customers in the coming Minnesota adult use market. Minnesota was the primary catalyst for our original investment in Goodness Growth. The exposure to Minnesota gives Goodness Growth a different opportunity set than many of its publicly traded peers. We’ve also recently written about how Josh is approaching investor relations and change management at Goodness Growth with two Bengal Bites (Parts One and Two).

We initially took our position in Goodness at much higher prices than today, so the position is now a relatively minor one in our portfolio. Still, we believe that the Goodness path is a positive one. Goodness has one thing in common with the most leveraged companies in the space: a change in perceptions about future business value by the market disproportionately affects equity pricing. When this change is positive, the effect on equity can be substantial. We believe Goodness could be a significant beneficiary of this “torque” if things continue on the current trajectory.

Bad Companies

Tell me that you are not a thief

Oh, but I am

Bad company

–”Bad Company” by Bad Company

In almost every single past letter we have voiced skepticism about the business model of large MSOs. The past year has given us no reason to reconsider - if anything, a fair reading of the numbers indicates that the businesses are largely getting worse, not better. We previously wrote that Schedule III does not generally change this view either - we simply believe that large MSOs will “over-earn” for a few years at best and then regress to much more modest long term margins (if any margins at all). Clearly, if we get increased cash flow from an improved taxation structure, that’s better for the sector and its largest operators, yet we view this as significantly more pro-credit than pro-equity, based upon these companies developing track records of operational success when competition arrives and their mostly atrocious capital allocation strategies. In this view, we continue to find ourselves contrarians to most other cannabis investors, who tend to uniformly believe that cannabis equities are “mispriced” (and generally assuming listeners will understand in context that this means undervalued rather than over).

Large MSOs could rather easily show our thesis to be wrong by doing the one thing that almost all of them have failed to do thus far: breaking out their financial results by market in order to make apples to apples comparisons easier. In the US, criminal arrestees have the Miranda right to remain silent and their silence cannot be held against them in a court of law, but Britain’s version of the warning is a bit different: “You do not have to say anything, but it may harm your defense if you do not mention when questioned something which you later rely on in court.” The British formulation makes more sense when judging companies. Large MSOs have been questioned and their silence is deafening - and that should tell investors something about how those underlying businesses are performing. Below we go deeper through why we believe most large MSOs are fundamentally flawed business models, what this implies for their valuations even with Schedule III, and address some likely counter arguments.

Please remember that we’re not bearish on the industry; we simply prioritize scrappy, localized operations and capital allocation based on returns on capital, as opposed to “how does this fit our retail investor relations story?” Admittedly, the storytellers have often done well for themselves in this industry, albeit often at the expense of almost all of the non-founding equity investors. It might be fun to name names of the most egregious one day…

Ants vs. Locusts

Go to the ant, thou sluggard; consider her ways, and be wise

–Proverbs 6:6

Ants dutifully build their colonies, carefully scaling in a methodical way. Locust swarms strip the landscape of whatever vegetation they can before moving on to annihilate something else. Locusts build nothing and leave nothing - there is no “residual long term value” created by a locust swarm. Good businesses are of the ant variety - methodically building value. Unfortunately, large MSOs tend to be locust swarms.

The stripped crop in the case of the large MSOs is high cannabis prices in limited license markets. Being early in limited license states gives them access to a time period where there is limited supply and high demand which in turn creates high prices and gross margins - our shorthand for this is the “CAP” or competitive advantage period. In this case, the MSOs core competency is government capture, not growing and selling quality cannabis at an attractive price. Prices decay at different rates in different markets because of numerous factors, but history has shown a few patterns no reasonable observer can ignore: (1) all markets eventually have prices come down; and (2) often the price decay is not linear and can happen quickly. Illinois, a highly limited market with high prices, still saw prices retreat 9% in 2023. Michigan, a more competitive state with no license limits, saw prices come down over 40% from 2022 through the end of 2023. Washington had a wholesale pricing crash of over 40% in a single quarter a few years ago.

Investors are missing the most consequential fact about large MSOs which will determine their long term value: they simply often struggle to make meaningful profits when prices approach anything close to a competitive level. Often the refrain is that many of these large companies still have “embedded growth” - invariably new states they are entering, or recent adult use transitions (Ohio), or anticipated adult use transitions (Florida), etc. But this embedded growth does not create value any more than a locust swarm jumping to its next patch of vegetation. These aren’t the kind of earnings one should pay a multiple for, rather you should value the surplus profits for the cash they put on the balance sheet. Ironically, a company’s divestment and retreat from a “weak market” is nowadays often treated as a smart capital allocation decision, rather than what it almost always is: a tacit admission that a company is a locust swarm which will leave no residual value after it uses up high prices.

A truly “weak market” is one where almost everyone struggles to consistently turn a profit. In US cannabis, this is only the case with California - other states have often been called some variant of “weak” by companies justifying their exits while plenty of other operators (often smaller and more nimble) can consistently still turn a profit there. Companies continually leaning on the “weak market” excuse remind us of this exchange from Glengarry Glen Ross:

Shelley (Jack Lemon): The leads are weak.

Blake (Alec Baldwin): The leads are weak? The fucking leads are weak? You’re weak.

We are not asking investors to make a large logical leap, but simply to acknowledge that how a company does in its initial markets as they get competitive is often a solid predictor of how it will do in its later ones.

Opaque Disclosures

Again, large MSOs have the ability to strike a fatal blow at our skepticism by just doing one thing: provide transparent financial reporting as to their operations in different markets. But, as yet, almost every major cannabis company has been loath to do so. Doing a state by state report would let a company show that it was doing well in its mature operations, allow it to show its investments for growth more clearly, and just generally provide a very good yardstick by which investors could judge progress in the business. All the more pity that often cannabis managements act as if investors who want this are asking to Xerox the top secret Coca Cola formula. Claims that disclosing more granular, state-by-state information would somehow be competitively damaging to these companies is ridiculous once an investor realizes just how threadbare cannabis companies’ disclosures are compared to other (very competitive) industries.

Historically, cannabis investors have been snowed as companies claim that disclosing more granular information would somehow be competitively damaging - this is ridiculous on its face as a wealth of information is often publicly available but just difficult for investors to pull together (e.g., cannabis companies often do not have confidential retail pricing on their online menus). It is even more ridiculous when comparing cannabis companies’ behavior to that of companies in other (very competitive) industries where management makes a committed effort to help investors understand the business from the outside in by showing truly relevant non-GAAP metrics. Any cannabis investor doubting this should take a quick peek at the disclosures of publicly traded car dealers or cable companies to see what “normal” disclosure looks like. Same store sales, in-depth sales segmentation by product, or even breaking down customer cohorts to show how longevity relates to purchasing are all regularly disclosed in other sectors. Transparent disclosures are table stakes in institutional-class industries and cannabis companies without similar transparency will simply never be assigned a “quality” earnings multiple by the market for any appreciable amount of time.

So why the silence? Well, the numbers simply would not make them look very good. Still, investors have plenty of existing data to extrapolate the reality of the situation: large MSOs depend on new markets for increasing profits in the future and profits in maturing markets are much more modest if nonexistent.

Patterns Repeating: The Large MSO Boom to Bust Cycle

One of the first questions financial results are meant to answer is a seemingly simple one: How is the business from last year doing today? Large MSOs, with exposure to states in different stages of maturity (e.g., assets in low priced Michigan and higher priced Illinois) are, as we discussed above, already difficult to parse because they do not willingly segregate results. Further complicating matters is that many large MSOs have both locusted their way out of more mature markets and locusted their way into new ones through divestments and acquisitions. As old abandoned markets are shoved into the accounting black hole of discontinued operations and new operations are consolidated in, it becomes increasingly difficult for an investor to get a quick feel for how last year’s business is doing this year because the very makeup of the businesses has changed year over year.

But, maybe despite best efforts, enough data exists to often show a pattern.

In our Q1 2023 letter, we wrote this:

The underlying pattern that we suspect is being played out repeatedly in many large MSOs is this: (1) enter a new market using relatively expensive sale leaseback financing to build a facility; (2) lack of cannabis building expertise leads to the facility being improperly or expensively built (i.e., spending $30mm on a facility with the performance of a well-built $5-10mm facility), and; (3) the facility is overstaffed and underperforms because of lack of operational expertise. This may seem far-fetched to some readers, but tigers don’t change their stripes - many large MSOs started as financial conglomerates buying up limited license pieces of paper and have minimal, if any, inherent ability to actually use those pieces of paper to make money, particularly as competition arrives.

For a few years, these sins were covered up by high cannabis prices in limited license markets, but those prices are now starting to come down. As prices come down, large MSOs look for a new state to enter which still has high pricing (read: New Jersey) in order to keep profitability up. In turn, large MSOs start to shutter or divest of cash burning operations if they can (e.g. Curaleaf’s moves to shutter its California, Oregon and Colorado operations), and often blame the market itself rather than their lackluster performance in it. If a company’s value is based on its future profitability, with future meaning beyond the couple of years when you can sell cannabis for $3000+ in New Jersey, then the values of many large MSOs look highly suspect.

We think there is now only more evidence that what we wrote is largely correct. Looking at a real world example demonstrates the point and, lest we be accused of punching down, we choose to look at the current most valuable cannabis company in the world: Curaleaf.

Curious Case of Curaleaf

To get a true apples to apples comparison (similar to a same store sales type analysis), it’s necessary to add back Curaleaf’s discontinued operations to compare Q3 2022 to Q3 2023. Doing so changes the reported numbers a little bit, but provides a fairer view in our minds of the development of the business. We also modify reported gross margin numbers a little bit by refusing to deduct inventory writeoffs, idle capacity, etc. from cost of goods sold (COGS) (if a company regularly has writeoffs and idle capacity charges it is “adjusting” out of gross margin, the fairer view is that this is just a normal operating cost rather than a one time fluke) and adding back in COGS from discontinued operations (indeed, this is the very point of our locust thesis: that these companies do not operate legacy assets well and that legacy assets are a window into the future of all of their assets). We do, however, add back depreciation and amortization charges included in COGS to try to get to a “cash” gross margin number - a modification favorable to the companies that overstates gross margins because at some point machinery does wear out and need replacement.

On our modified numbers we see revenue down 2% but gross margin percentage trimming down from close to 53% to just over 46% - a difference of over $20mm fewer dollars. This flows right down to the “adjusted” bottom line - reported aEBITDA margins were ~26% in Q3 2022 and down to ~23% in Q3 2023. We believe the real “apples to apples” aEBITDA margin is somewhere around 19%.

[Note: The paragraph below gets a few dates wrong. New Jersey adult use started in 2022, not 2023 - so the Belmawhr store was been contributing to Curaleaf’s Q3 2022 financials as well as Q3 2023. The underlying point we think still stands: if the New Jersey upswing, which was evident in Terrascend’s financials, only had Curaleaf treading water on revenue and continuing to lose gross margin - what does that tell you about how well things are going in their other markets? The original paragraph remains below.]

What makes these results interesting is that Curaleaf provided a data point which clearly shows the underlying crosscurrents in its business: in April 2023 New Jersey launched adult use cannabis to significant fanfare. Boris Jordan, Curaleaf’s Chairman, proudly trumpeted one month later that just one Curaleaf store in Belmawhr, NJ had a revenue rate of $100mm (Article in Inquirer). This store was not adult use in Q3 2022, so it undoubtedly significantly boosted results in Q3 2023, along with Curaleaf’s other New Jersey assets. As impressive as this store is, the question at the front of our minds is: If Curaleaf got this kind of boost in Q3 2023 but revenue was flat and gross margin was down significantly, what does that tell us about the performance of Curaleaf’s other assets? In other words, how much did performance in other states have to drop off to let the upswing from New Jersey only get Curaleaf back to neutral?

Many in Curaleaf likely understand that their subpar performance in many markets will be almost impossible to paper over with financial adjustments or management commentary at some point soon. And they certainly have enough financial savvy to know what happens when investors stop seeing growth in a “growth stock.” In this light, Curaleaf’s continual invocations of the coming German market start go from looking optimistic to looking desperate: Germany is far from being an added little bonus that investors get when they buy a share of Curaleaf, but an absolutely necessary part of the narrative that maintains Curaleaf’s growth story. We find it unlikely that the company that could not “draw,” much less “win,” in Colorado while other operators have managed to create solid, if unspectacular, cash flowing businesses, will be the company that “wins” Germany.

Curaleaf’s chairman has offhandedly mentioned before that the only operators making money in the markets that it exited were “mom and pops.” Investors did not seem to understand the weight of the admission: he was saying that Curaleaf was at a disadvantage despite its “superior” scale - a diseconomy of scale if there ever was one. If a mom and pop lemonade shop is somehow making more money than Minute Maid, that’s usually considered a significant problem for Minute Maid. We imagine a bored twentysomething CFA from a large institution listening to this tape jumping out of his seat - institutions are not known for their love of businesses with no scale benefits.

Despite what we think is clear evidence, Curaleaf generally trades at a premium to average multiples in the space. As we discuss in more detail below, there certainly could be some exuberant trading that happens which sends its stock soaring, but these moves would be unanchored to fundamentals. Far from being hurt by the supposedly low multiples generated by lack of institutions in cannabis, we think Curaleaf and companies like it are protected by it. Make no mistake: Curaleaf is simply an illustration of a broad phenomenon - there are many others.

What A Good Business Looks Like

As markets mature, the basic pattern matches Michigan even if there could be a difference in rates of growth, price decay, etc. As an illustration of what good businesses look like, the work below is meant to show what a proverbial good company would look like over time in an environment like Michigan vs. a bad one. “Bad” is used in the relative sense here - given a sufficiently cheap price, even a bad company could be a good investment. But the argument from cannabis investors is usually not that these are cheap bad companies, but cheap good ones with unappreciated underlying quality is. We disagree - there is generally no such quality to appreciate.

The assumptions here are not heroic for a well run company. Our proverbial good company would keep its market share (i.e., its unit growth would match the unit growth of the market), and follow the market on pricing as well. Lack of expensive sale leasebacks and decent operational competencies means that they get some modest benefit to scale in a slightly lowered cost per unit. Good overhead management means that their overhead as a percentage of sales falls as sales rise - a classic example of operating leverage. Most importantly, our good company does not deploy more capital into the market than it did originally - its efficiently-built facility just chugs along.

Critically, while seemingly all important metrics like gross margin and profit percentage go down, the much more important return on capital metric goes up - for the same investment, our good company generates more return. Again, profit dollars are what get taken to the bank, not profit percentages. Noted investing writer and theorist (and former colleague of Bengal partner Josh Rosen) Michael Mauboussin has written extensively on high ROIC driving long term returns in stocks, and we do not believe cannabis will be any different.

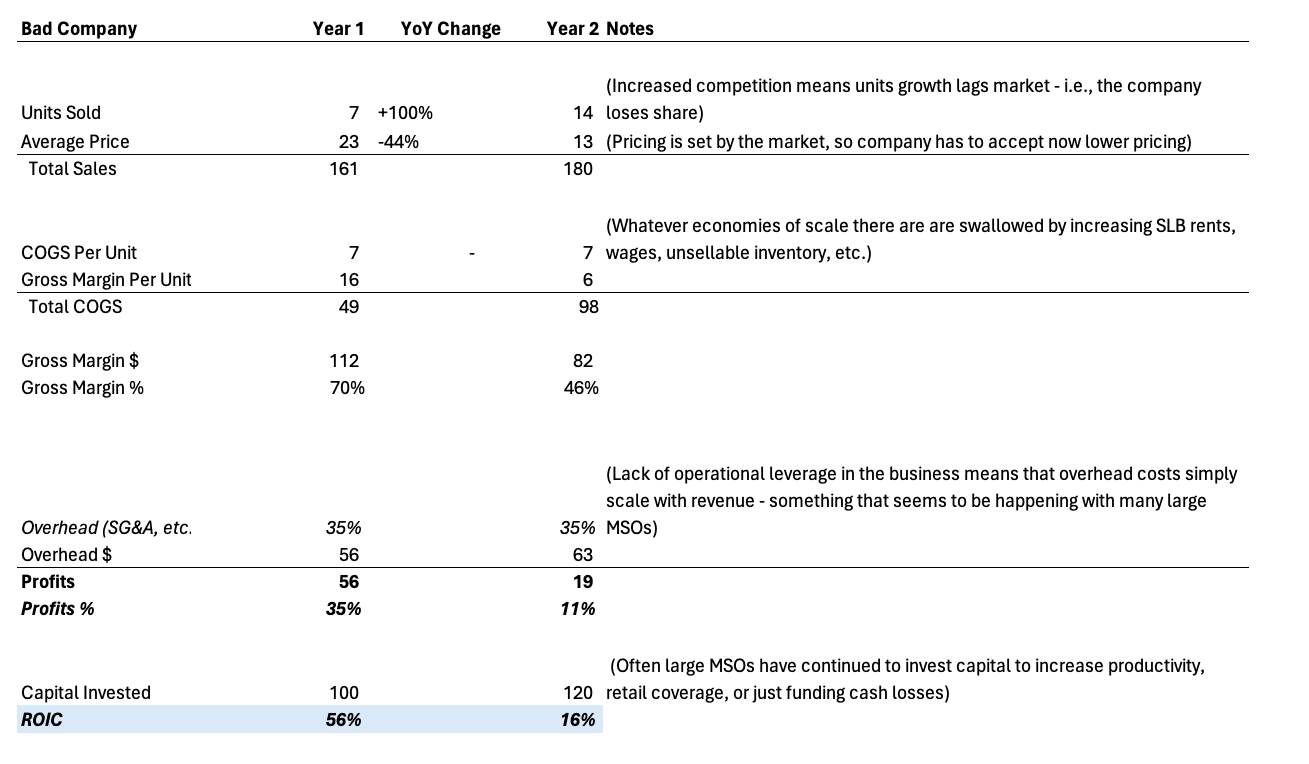

A bad company, as illustrated below, looks rather different.

Even with high unit growth, market share still recedes while market pricing falls. Whatever economies of scale exist are then swallowed by increasing wages, escalating SLB rents, etc. Operational leverage fails to materialize as overhead stays fixed as a percentage of sales - an actually generous assumption given the tendency of this number to go up as a percentage of sales in large MSO financials. Capital deployed often goes up as well as large MSOs try to shore up their competency gaps and inefficient initial spending - a classic “Red Queen” effect of having to speed up to stay in the same place.

From the same financial performance in year one, good and bad companies diverge massively. A bad company can effectively hide its terrible year two performance by entering a new year one market. But new markets will run out at some point soon; the US does not seem poised to add a significant number of additional states. Those that would say “well, year two still has ok capital returns, so maybe bad company isn’t so bad” are missing the fact that in the real world this points to an even worse year three.

Schedule III would not change these basic dynamics. Effectively, Schedule III would have the effect of making bad company’s year two look less bad and closer to year one. Investors should also keep in mind one of the more perverse effects of Schedule III: it functions as a sort of subsidy to the least efficient operators. Sounds crazy to say, but consider that under 280E companies were heavily punished in cash taxes for having large nondeductible overheads - a situation that would normally reward the leanest. Now as Schedule III would make high overhead deductible, and therefore no effective cash penalty for inefficiency in overhead, it narrows the gap between those companies with good SG&A spending and bad. But, again, it does nothing to change the underlying trajectory of good companies vs. bad. For a bad company Schedule III will be like a heap of ketchup on a rancid pork chop.

The only true outlier in this regard is GTI, which has demonstrated admirable margin control and, in our opinion, is the clear leader among large MSOs. Note that we do not hold a position in GTI in the Fund, but the founding Bengal partners were seed investors in GTI personally and maintain positions in it, and another Bengal partner has a position in the company bought in the open market. Yes, we talk our book, but there’s a reason it’s our book.

Zooming Out Doesn’t Help

To get a broader view, we expanded our analysis from Curaleaf to the top five MSOs by market cap (as mentioned above, excluding Verano): Curaleaf, GTI, Trulieve, Cresco, and Terrascend. Combining their financial results gives a general trajectory of underlying markets. In Q3 2023, these five companies combined were largely flat on revenue year over year, but had ~52% (again, these gross margins are calculated using our adjustments described above to get a better idea of “cash” gross margins) gross margins vs. ~55% the year before - a difference of $30mm fewer gross margin dollars in just Q3. Combined, their aEBITDA margins went from over 27% to under 26%. Individually, only GTI and Terrascend had higher gross margin dollars generated in Q3 2023 than in Q3 2022.

A sidenote on Terrascend: In Terrascend’s case, their growth came off of a much smaller 2022 revenue base and we posit that their financial results were substantially boosted by their large presence in New Jersey as well as their two aggressive acquisitions of Maryland retail assets just ahead of adult use. The Maryland acquisitions likely deftly captured more surplus temporary profits generated in that kind of adult use transition, but with a solid TBD on whether such acquisitions ultimately prove to generate adequate sustained returns on capital. In an area of the cannabis industry littered with bad/expensive acquisitions, and Terrascend’s own somewhat checkered history (we have always questioned both the wisdom of the Gage transaction as well as the price paid, perhaps with an even more jaundiced eye given it was a related party transaction), we believe the jury is still firmly out.

Regardless, further zooming out does not change our fundamental conclusions - with the exception of GTI, many of these companies truly can be painted with one brush.

Rescheduling and Valuation

In light of how we see the fundamentals of most large MSOs’ businesses, we do not believe there is a fundamental case for them being undervalued because the likelihood of long term value creation is low. This is a large part of why we have chosen to focus on smaller, more nimble operators which are, in fact, building long term value while foregoing some early market “surplus” profits. Given all that, here are some responses to common arguments about why large MSOs are undervalued even in with Schedule III being likely:

Large MSOs Will Make More Money: Maybe for a few years, but as we described above, the extra few years of surplus profits does not change what the business will do in the long term. This is often further exacerbated by their expensive sale leaseback and debt loads.

Large MSOs Multiples Will Expand: Arguments about higher multiples, when poked and prodded, tend to devolve into greater fool type arguments - that others will pay much more than you did for a stock regardless of its business performance. Wall Street Bets and the meme stock craze of 2021 has given many delusions of what “could” happen…in the same way that one of our particularly sporty Bengal partners “could” make the NFL after watching a documentary about Kurt Warner.

Fundamentally, markets assign multiples based on a judgment of two things: expected profit growth in the future and stability/risk of those profits. Again, noted investment author Michael Mauboussin has written papers (like this one) on this that any investor should read.

We see large MSO profits trending down in the long term as price normalization continues and being generally less stable as markets are still very much in their infancy in terms of product development and sophistication. This lack of likely long term profit growth and accompanying lack of stability weigh strongly towards a discount, rather than premium, multiple.Institutional Capital Flows Will Raise Equity Pricing: This argument implicitly assumes that major institutions will not be able to recognize the enormous problems with large MSO business models that we described above. This strikes us as unlikely, especially considering that by the time institutions look at the cannabis space in earnest there will be more financial data available and the trajectory will be, in our minds at least, even clearer.

Similar to arguments talking about how uplisting will “unlock value” (even though their TSX listings certainly don’t seem to have yet made a meaningful difference for either Curaleaf or Terrascend save maybe a small initial capital raise on the back of their uplistings), these arguments seem to assume that institutions “have to” own cannabis stocks as the “next hot growth story.” Those who make this argument should look at largely declining sustainable revenues in the space and realize that by the time “Institutional Capital” finally rolls around, the growth narrative may be even more damaged than it is today. With respect to actively managed institutions, investors should understand that many of them take quality seriously, and they will sharpen their pencil before hitting buy. For passive flows (e.g., index funds), investors should realize that the path to index inclusion is also not a given.

The institutional capital argument is sometimes framed as a “liquidity” argument - that additional liquidity alone will raise prices. MSOS was roughly 2/3rds as liquid in the past two years as it was in 2021 (measured in average daily dollar volume traded, not shares, since it is the more relevant liquidity measurement) and price plummeted over 70% in that time. Investors seem to think that adding that liquidity back will cause prices to go back where they were. But the world has changed, and prices reflect that.

Also, investors should remember that increased liquidity also makes it easier to short cannabis stocks - something which, the blowup of a few smaller funds notwithstanding, has seemingly been very profitable in other retail hype heavy sectors/companies. As one Bengal partner points out anecdotally, the only former institutional clients of his that made real money in cannabis did so betting against the Canadian LPs. Yes, the Canadian LP hype train made a lot of retail and smaller hedge fund investors money in the early days, including Jason Wild of Terrascend, but it wasn’t hard to realize the fundamentals weren’t there to support them. Perhaps we get another hype cycle in cannabis, perhaps not. But banking on a hype cycle to generate your returns is a strategy of hope as opposed to one of investing in and supporting solid growth businesses.

Investors also do not seem to count on another effect of increased liquidity: long suffering significant shareholders of large MSOs, previously realistically unable to sell their stakes, now having sufficient liquidity to begin selling. The increased demand for shares may well be met quite quickly with suddenly increased supply. The most significant near term damper on increased liquidity is that many companies will use that window to raise badly needed fresh cash with equity offerings given their debt loads. Some will even say it is to invest in growth or to plan for the future - usually this will be a bad cover for them trying to right bloated balance sheets but, as we discuss later, an even worse sign if they are serious.Weighted Average Cost of Capital, Cost of Equity and Debt, etc. Type Arguments: Similar to the arguments above, some argue that the 280E removal will cause a massive change in variables, and those variables naturally flow through valuation equations to cause a massive increase in value. For example, as Schedule III makes interest deductible, the cost of the debt will therefore go down, lowering the weighted average cost of capital, and therefore raising valuations.

Without diving too deep into technical arguments around valuation, we will just note again that all valuation techniques and their attendant variables are meant to try to elucidate just a couple of key pieces of information, namely: how much will a company earn in the future and how much will a market value these earnings (i.e., the multiple assigned to them)? Our core inescapable conclusion is that many large MSOs will simply not earn significant amounts of money, if any at all, as markets continue to normalize relative to how much they are worth now. As the market currently seems to understand that future profits will likely not sustainably grow after successive new market bumps, whatever change in variables like cost of debt and cost of equity will be more than balanced by the cold hard reality that these businesses are facing a stream of declining profits in the long term.

To be clear, there are other investors who may take different views and invest successfully on those views because their risk tolerance and/or target returns on capital are different from ours. We have always told our investors that our unofficial goal is to generate 3-5x returns over around five years in situations where the market misperceives profit potential and/or safety - what we term “unheroic performance.” Given that goal, quibbling about whether a large MSO should be assigned a multiple of 7.2x forward EBITDA or 5.7x is not the path to generating the returns that we aim for.Schedule III Is Not “Priced In”: Far from not pricing it in, we think the market could well be very efficient in realizing that the Schedule III gains are likely to be fleeting (again, we would not be surprised if there’s a hype wave that supports valuations for a relatively short window). Estimates of a company’s long term sustainable performance simply matter much more to its value than a likely temporary windfall from tax savings.

In 2018, the US Supreme Court issued a decision that allowed forty six states to legalize sports betting which was widely acknowledged by industry experts as a huge addressable market/profit expansion opportunity for gambling companies - a clear parallel in our minds to cannabis rescheduling. The price action of gambling stocks leading up to and after this decision combined with our now-existing six years of financial data of how the change actually played out leads us to believe that the market in cannabis stocks may also be much more efficient than appreciated by cannabis investors. We intend to write a Bengal Bite looking more deeply at the sports betting precedent soon.

Fairly looking at financial fundamentals leads us to the conclusion that cannabis stocks are not generally undervalued - and actually could be significantly overvalued in some cases.

Meme Stocks, Investor Excitement, etc.

Throw the rules out the window, odds are you’ll go that way too…

—Max Payne

Usually after annoyingly breaking down the fundamental case, you reach the real underlying reason why many believe cannabis stocks are undervalued: Schedule III (or whatever “catalyst” it may be in the future) will get people excited, and more eyeballs on the space, and more demand for the stocks, and prices will go up. Our biggest question to this line of reasoning is: if your view of value is not anchored to any fundamentals, how will you know when to sell? How will you know the mania is still on when MSOS clips over $13 (returning to where it was in roughly November 2022) or if the rally is petering out? Again, many cannabis investors seem to make the unwarranted jump that not only will “institutions” urgently need to buy cannabis stocks, but that they will urgently need to buy all cannabis stocks regardless of quality.

The famously curt (and Nobel Prize winning) theoretical physicist Wolfgang Pauli is purported to have once remarked that a young phycist’s paper was so bad it was “not even wrong” - that is, it was unfalsifiable. We have a similar reaction to investor excitement type arguments. How one underwrites whether the degen diamond hands on Wall Street Bets pick up MSOS as their next cause is beyond us.

Put another way, it seems clear that institutions would not rush out to buy iAnthus or MedMen stock were everything to be magically uplisted today. So why would institutions feel the need to buy companies which are clearly on their way to being the next iAnthus or MedMen or close? Proponents of investor excitement arguments never quite seem to understand that quality will always matter.

Yes, We Will Miss The “Trade”

We admit that there’s some chance that Schedule III or another catalyst will light the sector up and lead to large trading profits for those who participate. Should this rally happen, we will likely miss most of it - although we feel confident that our holdings would still see some benefit in that kind of scenario as well even if larger companies benefit more. We’ve always been upfront on our fundamental, long term focus. It’s been that focus that prevented us drawing down to anywhere near where MSOS ended up and it will hopefully be that focus which allows us to deliver sustainably better returns over the long term. Put simply, if we were standing at a roulette table and a random stranger walked up to it, bet his house on red, and won, we would be happy for him - his win is not our loss. But we would not exactly be rushing to take financial advice from him either. So it is with proponents of the “trade.”

We continue to believe that any trading runup would not be anchored to fundamentals and therefore overly volatile and short. We have no edge in that kind of environment, and think many of those who claim to do not either. All the drapings of finance and squiggly lines drawn on stock charts cannot hide that this is much closer to gambling than investing.

Beyond the principle, the tactics are often questionable to us as well. To the extent that investors believe that Schedule III is not “priced in” to the market, and wish to bet on the market suddenly pricing Schedule III in, there seem to be far better ways of making that bet than simply taking a position in fundamentally subpar MSOs. Especially with options coverage on MSOS, investors have tools which seem to better isolate that particular bet without being exposed to other noise. Furthermore, investors can often add their own leverage in place of a company’s - e.g., an investor can use margin to purchase GTI (effectively creating a more leveraged bet) instead of buying a company like Ayr (where the leverage is already inside of the company) - in order to get more leverage on their bet without being exposed to lower quality equities. But, again, this is not our bailiwick (and is certainly not financial advice to anyone).

Diworsification

Note: Again, this discussion leaves out any analysis of Verano due to the pending litigation with Goodness Growth. The fund does not maintain a position in GTI, although Bengal partners that were seed investors in GTI maintain their personal positions and another Bengal partner has GTI stock in his personal account.

In cannabis, the clear large MSO “quality” leader appears to be GTI. It is certainly not a perfect company, but its financial performance and capital allocation seems to be significantly better than its peers. Management has never adequately explained the departure of independent board members last year and generally hues towards lack of disclosure when it comes to giving investors insight into how its operations are performing on a state by state basis. In our eyes, the risk is less that management is hiding something nefarious and more that management eventually becomes so “imperial” as to not be meaningfully checked by the board and/or non-insider shareholders. A minor concern, but worth pointing out that the best in class large MSO is still not exemplary in an absolute sense. Financial performance has been very good, especially as GTI has demonstrated consistent cost controls - the best way to cut overhead costs is to make sure they never get too high in the first place. And outside of the board departures, we commend GTI for having a very stable management leadership team.

More to the point is that cannabis investors seem keen to “diversify” into different companies to assemble some kind of perfect basket of exposure to different cannabis markets. The analogy we’ve often used is playing Monopoly when you should be playing Risk. But investors should keep in mind that they are buying operating companies and not just chunks of state market share. Even good performance in one state can be dragged down by decisions in others. For example, Trulieve does very well in its home market of Florida and likely still does decently well in Harvest’s home market of Arizona, but has demonstrated near zero ability to create a successful business outside of its home states - and no inclination to stop trying (e.g., Georgia, West Virginia, etc.). So an investor using Trulieve as a bet on Florida is maybe getting a bit more than they bargained for…or less?

Presence in every market is not required to create a good business. Investors looking for large MSO exposure don’t seem to be able to do much better than GTI - mixing it with significant amounts of other larger MSOs just seems to weaken the tea. For example, buying Curaleaf to pair it with GTI does nothing in our eyes but make things worse - we believe Grimm’s Fairy Tales as much as we believe Curaleaf's German (and probably soon to be Polish) profit predictions.

GTI is large enough, broad enough, and high quality enough to be able to “catch the beta” without making fundamental sacrifices on quality like a poor balance sheet (Curaleaf, Cresco, Terrascend), historically bad capital allocation/M&A (Curaleaf, Cresco, and Trulieve to some extent), a history of letting overhead expenses run wild (Curaleaf, Trulieve), etc. We believe that investors who “diworsify” their cannabis holdings are not reducing risk and increasing potential returns but exactly the opposite.

Opportunities We Currently See

Large MSO Debt

In contrast to our long term skepticism for many large MSOs’ equity values, we believe that Schedule III is not properly appreciated by debt markets, and that some large MSO debt is likely mispriced as a result - i.e., yield available on some large MSO debt is significantly higher than one could get by taking a similar amount of risk in other companies. Currently, junk bond yields are hovering just under 8%, or a roughly 400 basis point spread over the US 10 year treasury bond, while some large MSO debt trades at yields over 11% - so a 300 basis point further spread on top of junk bond yields.

Broadly, junk bond issuers have interest coverage ratios hovering around 2-3x, while these larger MSOs are significantly higher (closer to the range of investment grade companies oftentimes). 280E removal would very likely only bring near term improvement, and most of the debt MSOs hold is not long duration as well. So, in short, these debt yields seem too damn high given the risk. With short maturities coming up, there seems to be potential value here.

We believe there is a window to deploy significant capital into a strategy that mixes positions in higher credit quality larger MSOs with some higher risk bets in debt of carefully selected lower quality companies into a portfolio that combines strong cash on cash returns with outsized upside potential from debt extension/modification equity sweeteners (like those seen recently with Ayr and Cannabist debt).

If you are interested in working with us to pursue such a strategy, please let us know by emailing jerry@bengalcap.com.

Small (Money) Ball

Looking is not the same thing as seeing. Moneyball, the famous Michael Lewis book later turned into a Brad Pitt movie, shows that decades of people looking at baseball did not lead to them seeing the fundamental factors which were actually driving results. Our approach to cannabis investing, small ball, is temperamentally similar. We continue to believe that, with the possible exception of GTI, large MSOs will not create long term shareholder value and hence we focus our efforts on companies which we believe will.

We continue to believe our portfolio is trading at significant discounts to fair value. Outside of our portfolio holdings, we believe there are a few potential opportunities worthy of attention. There are fewer such companies than when we started the Fund in 2021, but the opportunities that remain strike us as generally better quality. So, we have plenty of capacity to deploy more capital into our small ball strategy at the Catalyst Fund.

A View of the Likely Future

Finch: …I felt like I could see everything that happened, and everything that is going to happen. It was like a perfect pattern, laid out in front of me. And I realized we're all part of it, and all trapped by it.

Dominic: So do you know what's gonna happen?

Finch: No, it was a feeling. But I can guess…

–V for Vendetta

Rescheduling will come, but not soon enough for many overleveraged companies which will give away significant equity upside in order to win debt concessions - again, something already seen at Ayr and Cannabist - with the recent uptick in cannabis equities perhaps making it somewhat less dilutive. Those that can hold out until rescheduling will experience a year or two of significant tax windfalls even as continued price declines somewhat moderate the effects. Some, but not many, cannabis companies will continue to make strides in being more transparent with their financial results as they realize that doing so will give them a potential cost of capital advantage over some of their peers who aren’t doing as well.

Almost needless to say, any broader euphoria around equity prices will be used by large MSOs to raise equity, often leaving existing investors in the same place or worse on a per share basis. Of those that are able to raise equity, most of that cash will be used to pay down debt but some companies will manage to work out a way to deploy some significant portion of their 280E savings windfall into new opportunities for “growth” - this latter group should be by far the most worrying given the history of capital allocation in the cannabis space.

What Good Are Wasted Profits?

Again, a specific example of capital allocation to bring things into focus: Trulieve generated over $100mm in cash from its Florida operations in 2020. By 2023, pretty much all of that cash flow and maybe more was gone, never to be seen again - burned by the company in an unsuccessful attempt to expand aggressively into markets like Massachusetts while they integrated the acquisition of Harvest. While many issues at Trulieve are blamed (unfairly in our view) on the Harvest acquisition, Massachusetts was an organically created mess as what worked for Trulieve in Florida does not seem to be the playbook to apply in other markets.

We freely admit that Florida adult use would allow Trulieve to effectively print money for a few years (we note that the CEO of Florida operator Cansortium, attorney Robert Beasley, was not optimistic on adult use prospects in a recent podcast appearance) - but what good is printing money if it is just going to be squandered by poor capital allocation like what happened in Massachusetts?

What use are significant windfalls at Curaleaf if they are just going to be wasted on acquisitions like the ones they made and discarded in California, Oregon, Colorado, Massachusetts, etc.? What use are extra profits to Cresco Labs if they are just going to acquire another promotional gasbag like Origin House? Terrascend/Gage, the list could go on for quite a while. Institutional capital, when it comes, will look at this history seriously, and they will not like what they see.

Barricaded Managements

Maybe not always being right, but high quality managers at least admit their mistakes. The cannabis industry has not experienced this, instead being in a new nadir of obfuscation as many executives scramble to do anything other than admit missteps and tell investors what they really think is going to happen in the future. It does not have to be this way, and we believe that institutions analyzing this space will begin to ask uncomfortable questions of current management as Schedule III approaches.

Sergio Marchionne, then-CEO of Fiat Chrysler and widely considered one of the best automotive CEOs of all time, in 2015 gave a presentation called “Confessions of a Capital Junkie.” It is legendary in its forthrightness in laying out the fundamental issues with the automotive industry at that time. He laid out a frank analysis of the issues, made no excuses, and laid out a plan for tackling them. He would later largely do what he said he was going to do, and ultimately set Fiat Chrysler on a much more successful path after having been in the doldrums for years.

If what Sergio put together is a novel, then today’s large MSO management teams (save Ben Kovler and his team at GTI) seem largely incapable of putting together a picture book. The industry, and investors, deserve better but, paradoxically, we likely won’t see material progress on that in 2025 as Schedule III excitement protects subpar managers.

All Of This Has Happened Before

Sharon: …You gave a speech, it sounded like it wasn't the one you prepared. You said that humanity was a flawed creation, and that people still kill one another for petty jealousy and greed. You said that humanity never asked itself why it deserved to survive….

Maybe you don't.

–Battlestar Galactica

In the context of underlying high growth markets which no one denied and yet stock performances that never failed to disappoint in the long run, airlines stick out. From 1971 through 2015, the percentage of American adults who had ever flown went from 49% to 81% while the percentage of those who had flown in the last year went from 21% to 45%. When looking at numbers of actual people, you can see that airline travel growth likely grew at over four times the rate of population growth - a huge “sectoral tailwind.” The overall inflation-adjusted market for air travel in the US was probably over three times bigger in 2015 than 1971.

Yet of the top four airlines in America (American, Delta, Southwest and United - fifth place Alaska flies less than a third of the passengers that United does yearly), only Southwest has not filed for bankruptcy in its history. And this understates the case since many large defunct airlines have been absorbed into the current top four - like TWA was absorbed into American during its bankruptcy.

These stories took decades to play out but cannabis promises a much faster cycle: anywhere from 13-20% of adults already use cannabis regularly and converting them to the legal market is going to be a much faster process than convincing the majority of Americans to get onboard a flying metal tube at hundreds of dollars a pop. That conversion of illicit demand into legal markets will drive great results for consumers and society generally, but be particularly brutal on companies that have demonstrated minimal ability to consistently make money in today’s higher priced world.

A Final Shock

Many shall be restored that now are fallen and many shall fall that now are in honor.

–Horace

The terminal equity value of a company which will not earn its cost of capital over a full cycle is zero. The very online cannabis investing cohort spends much of their time not debating whether cannabis stocks (almost invariably large MSOs) are undervalued but to what extent they are undervalued - undervaluation is more or less a given. We urge them to consider a more troubling possibility: what if their favorite cannabis company’s stock is worth zero? Maybe not literally zero, but worth nothing in terms of extra investment returns over just owning an S&P 500 index fund - or even less than nothing.

What if, after all is said and done, we look back in ten years and large MSOs’ split and merger-adjusted stock price charts look much like Tilray, Canopy Growth, and Aurora’s do today? As investors assign probabilities to future scenarios, we find ourselves in the unenviable position of pushing them to at least consider a world where the cannabis markets grow in volumes and their pet companies make less as a result.

Conclusion

Our financial performance this year supports our point of view, but we warn investors that we fully expect our results to be more volatile because of our concentration and illiquidity. We expect that there will be times that we underperform relative to MSOS, but firmly believe that our approach will create better returns compounded over the long term. We freely admit we could miss the “trade” and lose out on tremendous profits but while we may not make as much as others we will be satisfied in losing less - and hopefully helping to build solid growth businesses in the process. As always, we look forward to updating you on our progress.

Should you wish to respond to this letter or discuss anything within it, please reach out to Bengal partner Jerry Derevyanny at jerry@bengalcap.com. We are always happy to thoughtfully engage with those that agree and disagree with us.

Disclaimer

The information contained in this letter is provided for informational purposes only, is not complete, and does not contain certain material information about our Fund, including important disclosures relating to the risks, fees, expenses, liquidity restrictions and other terms of investing, and is subject to change without notice. This letter is not a recommendation to buy or sell any securities.The information contained herein does not take into account the particular investment objective or financial or other circumstances of any individual investor. An investment in our fund is suitable only for qualified investors that fully understand the risks of such an investment after reviewing the relevant private placement memorandum (“PPM”). Bengal Impact Partners, LLC (“Bengal Capital” or “we”) is not acting as an investment adviser or otherwise making any recommendation as to an investor’s decision to invest in our funds.

Perhaps most importantly, Bengal Capital has no obligation to update any information provided here in the future, including if any positions discussed are sold or purchased, or if different positions are purchased.This document does not constitute an offer of investment advisory services by Bengal Capital, nor an offering of limited partnership interests of our Fund; any such offering will be made solely pursuant to the Fund’s PPM. An investment in our Fund will be subject to a variety of risks (which are described in the Fund’s definitive PPM), and there can be no assurance that the Fund’s investment objective will be met or that the fund will achieve results comparable to those described in this letter, or that the fund will make any profit or will be able to avoid incurring losses. As with any investment vehicle, past performance cannot assure any level of future results.We make no representations or guarantees with respect to the accuracy or completeness of third party data used or mentioned in this letter. We provide services, such as strategic consulting services, to certain entities mentioned in this letter and may in the future provide such services to more in the future, or to companies not mentioned in this letter. While we may sometimes advise on issues regarding corporate communications, we do not believe any of the services which we provide are “stock promotion” - we have not been and will not be compensated for the mention or discussion of any of the companies discussed herein. We disclose such arrangements to investors in the Fund and will continue to do so.