Bengal Capital - Q1 2025 Letter

Misspent Youths - Why Large MSOs Past is a Preview of Their Future

The following letter was sent to Bengal Catalyst Fund, LP investors today.

—

Dear Investor,

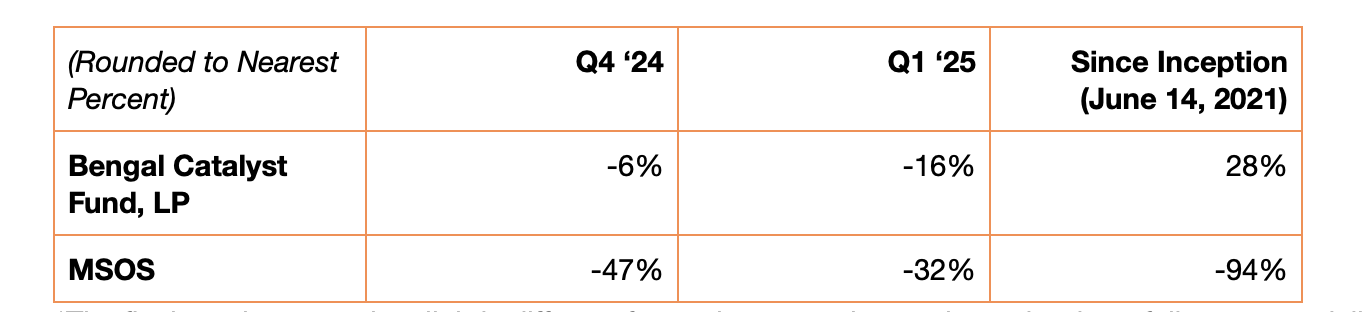

The Bengal Catalyst Fund, LP’s (the “Fund”) performance (preliminary estimates, net of fees, and unaudited) is presented below alongside that of MSOS, a US cannabis-focused ETF. We do not consider MSOS a benchmark but rather a reasonable indicator of US cannabis investor sentiment.

*The final numbers may be slightly different from what we estimate above, but hopefully not materially so.

The Fund’s Q1 2025 performance was in part a function of arbitrary timing. Grown Rogue reported its 2024 earnings on March 31, 2025 in the evening, and its stock price dropped from around $0.52 to $0.41 the following day - it hovers at around US$0.47 as of this writing, putting the Fund down roughly -21% year to date.

Why did the market seem to punish Grown Rogue?

Grown Rogue’s change of year end from October to December made it difficult for them to assemble comparative quarterly periods - very different from if they had moved from a September year end to a December one, in which they would already have a December quarterly financial statement. GR decided not to print a quarter over quarter of year over year comparison in its PR, which left investors unmoored during a time when many peers are struggling and Grown Rogue’s two legacy markets of Oregon and Michigan are experiencing pricing pressure, which Grown Rogue is not immune to.

The seemingly large drop between Q3 and Q4 revenues made it look like GR’s business was rapidly deteriorating. This was compounded by poor investor communications from GR which exacerbated the problem. For example, GR’s PR did not mention that Vireo consulting revenue was present in Q3 and not in Q4 - and it generally did not focus investors’ attention on what really matters for Grown Rogue’s ability to build long-term value: its continuing operating strength in mature markets like Oregon and Michigan.

Generally any one press release is not a huge deal, but taking true fans of your company and making them unjustifiably nervous about the future is an own goal.

Fundamentally, what we think the market “misses” about Grown Rogue (but which an increasing number of investors are starting to notice) is that its core operating performance in Oregon and Michigan allows us to underwrite its future profits in other markets with confidence. We do not expect profits to go up every year in mature markets because of natural cyclicality, but Grown Rogue has demonstrated that it can still generate cash in tough pricing environments while generating great returns over the course of a pricing cycle.

In the current cannabis environment, Grown Rogue can profitably take advantage of two ways to enter a new market: a new/upgraded facility they build (such as Michigan and New Jersey), or step into a distressed facility at a discounted cost (such as their second facility in Oregon, which was bought from Acreage for $3m a few years ago and is generating significant return on investment even with lower Oregon pricing). This core capability is what drives value creation - pedantically focusing on fluctuations quarter over quarter or year over year misses the forest for the trees.

A few reminders:

Your results may vary from those above depending on time of investment

The above figures do not include the results of any side pockets

We expect our returns to be volatile given the illiquidity and concentration of the Fund’s portfolio. Regarding the last point, we fully expect that there will be periods in which we underperform the broader cannabis equity market as we seek to generate sustainably better longer-term returns.

Your individual account statements should be available soon at the Panoptic investor portal. Please reach out to us if you need help accessing them.

As is our usual practice, we are sharing some thoughts regarding the cannabis investment environment below. Please feel free to share with others.

Bengal Commentary - Q1 2025

Disclaimer: No More Bearish Talk (After This Letter)

We’ve long discussed why we are skeptical of most publicly traded cannabis companies. Looking at recent earnings and industry developments, we don’t see anything that makes us question our views.

Some question why we spend so much time talking about stocks we do not own (and are not short). The main reason is that discussing the problems we see in MSOs is the foundation for discussing why we think companies like Grown Rogue will be successful long term - we challenge the conventional cannabis wisdom because there is so much groupthink in assuming that the existing large companies are destined to be long-term winners to set the table for why we invest differently.

Although the persistent challenges of operating and investing in the cannabis industry have turned many off, we believe in the underlying volume growth of the regulated industry, providing ample opportunities for strong, disciplined operators to build resilient businesses and selective equity investors to perform well.

At this point we have largely said our piece. Unless there are drastic changes in the prospects of larger MSOs, we intend that our future writing focuses more on discussing what we do (or would like to own) rather than what we don’t. We think there continue to be ample opportunities in the industry - just not where most believe they exist.

Misspent Youths

We try to focus on determining how much profits a company will make in the future to determine what its value is today. Looking at a company’s capital allocation is key to this - a company takes capital, be it equity or debt, and converts it into assets. Those assets are supposed to generate profits- enough profits to service the debt and leave something for equity as well. Every company, like every human, sometimes makes mistakes, but a company’s overall record of capital allocation is a window into its future performance.

While a somewhat broad, imprecise measure, looking at return on assets is revealing of MSOs’ capital allocation records and whether they can be trusted to generate future profits from the investments they are making today. If a company has a history of not generating adequate returns then, absent a major management change, there is no reason for investors to think that future performance will be any better than past.

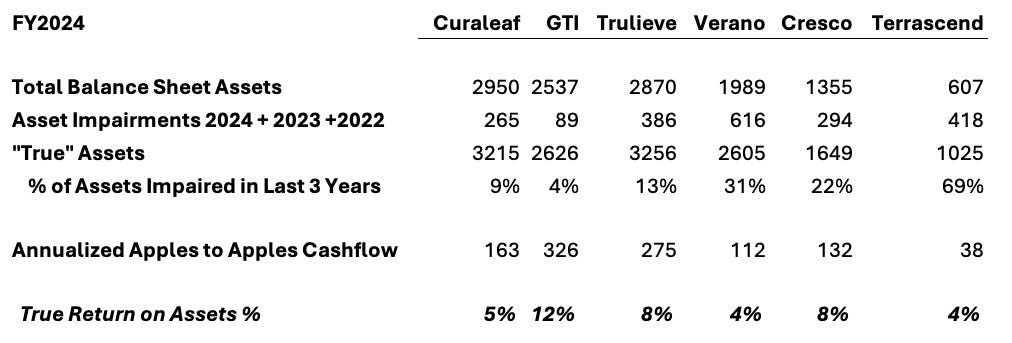

MSOs have largely had misspent youths - a bevy of investments that have not panned out and contribute to destruction of shareholder value which investors are ignoring at their peril. Looking at the top six MSOs demonstrates this well, with a few specific examples of poor acquisitions by Verano and Terrascend. The examples we include are not exclusive - even GTI, which we consider best-in-class among the larger players, has made at least one questionable acquisition.

Past Performance Is Indicative of Future Performance

The chart below takes “apples to apples” cashflow (i.e., adding back the taxes GTI paid in order to match them with the other MSOs which are already not paying 280E taxes as reflected in their cashflow from operations, and normalizing Trulieve’s cashflow for refunds received and political donation expenses) and compares it to the total assets on the companies’ balance sheets as of the end of 2024.

Some stark differences emerge quickly - like how GTI is able to generate over twice the return on assets of Curaleaf, Verano and Terrascend. But, to get a more accurate picture of a company’s true capital allocation record, you need to add back impaired assets - previous investments that have already been written off. Adding in impairments only makes the differences starker:

“So what?” you might say. How big can a couple points be? The following chart shows the difference between $1 compounding at 12% annually vs 8% annually. The end result is quite…big.

Of the top six, only GTI is able to generate a return above 10% - and, as we discussed in our annual letter, there are many reasons to believe that heavily Florida-exposed companies like Trulieve, Verano, and Curaleaf will continue to see pressure on their cashflow generation from price normalization which, without meaningful market share and/or efficiency gains will lead to lower return on assets over time.

Yesterday’s Cash is Today’s “Noncash” Adjustment to EBITDA

Asset impairments are probably the most widely ignored charges in cannabis, and maybe in all other sectors too. They are adjusted out of EBITDA and left sitting somewhere without a second thought, with the underlying rationale being that they are backward looking and noncash. But sometimes asset impairments mean something - it means that the company paid much more for something in the past than that thing is worth today. Reflexively waived away as a “noncash” charge, asset impairments often relate to cash or equity (dilution) a company used to make acquisitions just a few years ago. Verano provides a relevant example.

Verano’s Buying Spree of Pennsylvania Lemons

Verano purchased three different companies in Pennsylvania in 2021:

Agrikind purchased for $66m in cash, $50m in stock, and up to $32m in earnouts

Agronomed purchased for $60m in cash and stock

The Healing Center purchased for $55m in cash and $55m in stock

In the last three years, Verano has taken at least $355 million in asset impairment charges related to writing off assets in Pennsylvania. Calling these impairments “noncash” ignores that these impairments represent well over $100m in actual cash spent just over four years ago - not to mention that giving away a company’s equity for things that end up not being worth much is another serious problem, particularly if the core business was stronger.

What did Verano buy for all this cash and stock? Verano’s old state by state disclosures provide a clue. Verano’s FY 2023 earnings press release showed their Pennsylviania assets generated $55m in retail revenue and $16m in net wholesale revenue for $71m in total. So, in 2021, Verano paid at least four times two years forward revenue for those Pennsylvania assets.

Based on Verano’s first three quarters of 2024 disclosures, it looks like its Pennsylvania business was trending to do 15% less revenue last year than in 2023, or around $60m total, so its acquisitions in 2021 would be at almost five times revenue in 2024. Verano’s acquisitions are looking worse and worse over time. One should seriously question that even if adult use comes soon to Pennsylvania whether Verano will see multiples of improvement in its performance.

Supporting a pessimistic view, what makes Verano’s performance look even worse is that Pennsylvania's medical market grew between 2023 and 2024 by about 9% - meaning Verano is losing share rapidly in a market that they paid hundreds of millions to get into.

Dues Ex Adult Use

A state going adult use does not magically wipe away all past mistakes in that state, as cannabis investors should know by now. Price normalization and competition come quickly - New Jersey is a good example of a state that likely generated incredibly good profits initially and is now trending down to a much more normalized level, albeit still with very healthy profits for many.

To get a decent return on the hundreds of millions it spent, Verano would need the kind of unicorn scenario in Pennsylvania that just doesn’t happen anymore in US cannabis - new adult use states are often surrounded by existing adult use states so they don’t enjoy the same sustained levels of super high prices and demand as before.

Equity Ends Up As Cash

Investors are even faster to brush away noncash impairment charges when they relate to previously issued stock consideration. Writing off previously issued stock is surely “noncash,” right? We’d urge investors to think about it a different way.

Let’s say you and a partner had a lemonade stand that made $1m per year in profits. LemonadeCo has 100 shares of stock and each of you own 50, so you split the profits 50/50 and enjoy your $500k dividend.

Your partner meets a fast talking guy named Bruce who has a startup lemonade stand that doesn’t make any money but tells him that a rollup of lemonade stands will bring synergies and also happens to be popular with the Canadian capital markets so you can use a bucketshop bank to do an RTO into a shell and then raise a convert…honestly you stop listening at this point because it gave you a headache, but you told the partner to go ahead and see how it goes. Your partner buys Bruce’s stand for 50 shares of stock.

Bruce’s lemonade stand just breaks even. With surprise, you see that this year’s dividend check is only $333k since one third of your original lemonade stand is now owned by Bruce. Bruce goes on Canadian CNBC and waxes poetic about the long-term strategy of carpet bombing the world with lemonade stands, but your dividend check gets smaller and smaller.

Cannabis investors say “dilution” when they just mean issuing shares, but this example is actual dilution - issuing equity in a way that means that each share is entitled to less profits in the future. So calling an impairment “noncash” ignores that, at some point, those bad acquisitions directly mean less cash flowing into the hands of existing shareholders.

An Example: Terrascend

In early 2022, Terrascend acquired Gage, a Michigan operator, by giving away just shy of 20% of the combined company in an all stock deal valued at $545m. Jason Wild, chairman of Terrascend, controlled >30% of Terrascend and also controlled 16% of Gage, but the transaction was recommended by an independent board committee and approved by shareholders.

Gage’s 2021 revenue was $95m with gross profits of $29m, with salaries and benefits expenses alone of $20m, contributing to cash flow from operations of negative $34m. Terrascend's Michigan operations had EBITDA losses of $5m in 2022, although it exited the year trending towards EBITDA breakeven. In their 2022 earnings call, Terrascend guided that Michigan operations would be EBITDA and cash flow positive in the first half of 2023.

But by the end of 2023, Terrascend moved the goal posts slightly - Michigan was now only “EBITDA profitable” with no mention of cash flow positivity. By the end of 2024, Terrascend continued to reiterate that they were focused on “optimizing state-level operating expenses in Michigan” - a likely tacit admission that cash flow positivity was nowhere to be found.

It is difficult to see how what Terrascend bought in Gage is anything close to what Terrascend’s chairman described as a company with “pristine operations” on a call in March 2022. Conversely, it is relatively easy to see why Terrascend was forced to take a $311m impairment related to its Michigan assets in 2022 - waving away the impairments as “noncash” ignores that 20% of Terrascend was given away for assets that are not cash flow positive even years later.

The same management that spearheaded the Gage acquisition is still in charge of Terrascend, and continues to do more, albeit smaller, acquisitions in Maryland and Ohio. Given their track record, why should investors expect significantly better results from these acquisitions than Gage? Maybe these acquisitions are better, but it seems as though no one is even asking the hard questions.

Again - Where Do Multiples Come From?

Multiples come from anticipated future profits. To get a higher than “market” multiple, companies need to show they are going to grow profits faster than average. The S&P 500’s anticipated profit growth for this year is 5% - how many of the top MSOs can credibly say that they are going to do better given their track record? And how many can credibly say they are going to continue to do better in future years as the profits from their past investments continue to whittle away? Even current analyst estimates are predicting muted (aEBITDA) profit growth:

(Source: ATB Capital Markets)

Companies that have a reliable track record of investing capital and not actually generating profits do not get high multiples. Companies that used significant amounts of debt to do this have much more to worry about than their market multiple. Shareholders end up bearing the maximum pain of a company’s bad decisions - so looking at a company’s track record of decisions should be front and center in investors’ minds. So, despite claims that the cannabis market is “inefficient,” the overall move in equity values in cannabis is fundamentally sound:

(Source: ATB Capital Markets)

Mistakes are easier to see in hindsight, but there were many reasons why large MSOs should have known that the acquisitions and expansions they were making at the time were mistakes. This is not just armchair quarterbacking.

MSO Fat Camp

When relating the advice he’d been given on how to lose weight, Orson Welles said: “My doctor told me to stop having intimate dinners for four. Unless there are three other people.” MSOs started with solo intimate dinners for four and are now down to maybe three or two adults and a child. Better, but not a path away from corporate obesity.

Most large MSOs have paid some lip service to cutting overhead, returning to their “core,” or some other anodyne phrase for trimming the fat. Whether the goal is admirable or not for many is irrelevant because it’s necessary given their increasingly stressed cash generation. Beyond that, many investors seem to misunderstand that firing people at headquarters is the lowest hanging fruit in dropping costs - further gains inside of grows, processing, and stores are much harder to come by.

Why is the “belt tightening” argument not convincing?

Many growing and processing costs are fixed. So, the lights are on and electricity is being used whether you get a good harvest or a bad harvest. A bad (lower yield) harvest will naturally have higher costs. Turning off the lights (i.e., cost cutting) is not the answer - you need to get more productive to cut costs rather than trying to find pennies in the couch. But, as we’ve discussed many times before, large scale productivity improvements are not something most large/medium MSOs are built for.

And, we know that at least a significant portion of many MSO costs are not going down: rent. Even if the leases do end up getting cut a bit, the price exacted on the equity will be especially dear - IIPR has made that clear in their (short-lived) resolution of the PharmCann defaults. Many of these facilities are simply not properly scaled nor efficient enough to warrant their price tags, which will severely limit how much a follow-on tenant will be willing to pay to rent them as well.Cutting some marketing people and a few extra executive assistants from overhead will not fix this massive underlying driver of structurally higher costs.Otherwise, most of the touted improvements are too small to make a difference or suffer from a gamed basis - like Cresco showing better (but not great) margins in 2024 over 2023 because 2023 included many merger-related costs from Cresco’s failed merger with Cannabist.

Trulieve’s gross margin improvement year over year is also very different from finding pennies in the couch and optimizing what is already there. Instead, Trulieve invested significant incremental capital (its spending on property, plant, and equipment was over $100 million in 2023 and 2024 combined and we believe much of this went to its Jefferson County facility in Florida) in order to improve these gross margins - with Florida’s coming price compression, the long term return of this incremental capital remains to be seen. But, Trulieve’s improvement should be looked at very differently from that of a company that is able to do more with less.

The touted improvements also largely ring hollow because we have a counter example of GTI. A large company that has competed in many of the same markets as the other players, has faced many of the same market forces (although, notably, has been likely much more insulted from pricing pressure in its core Illinois market), and has deployed significant growth capital over the last few years, has done so while maintaining consistently better normalized margins than the other large players and more reasonable overhead costs.

Conclusion

As we said at the start, we realize our commentary is somewhat repetitive at this point on the topic of large MSOs. So, we look forward to discussing other opportunities, i.e. things we are actually excited to invest in, in the future. If something changes, we hope to be the first to admit it. But, until then, we think those that make the most money on large/medium MSOs will be restructuring consultants and lawyers as cashflows continue to be stressed and painful workouts negotiated.

-

Should you wish to respond to this letter or discuss anything within it, please reach out to Bengal partner Jerry Derevyanny at jerry@bengalcap.com. We are always happy to thoughtfully engage with those that agree and disagree with us.

Hey Jerry, thanks again for sharing your investor letter. Sent you an e-mail with some questions on GR's annual report from a new address (park.666@osu.edu>osugimp@yahoo.com). Looking forward to more of your insights, thanks for your time.

As usual, your commentary is spot on and extremely useful for cannabis “investors” to read, as it provides a clear dose of reality. All of these stocks were way overvalued 4 years ago because none of these investors understood the basic fundamentals of having a long term profitable business.