The following letter was sent to investors in the Bengal Catalyst Fund, LP today.

Dear Investor,

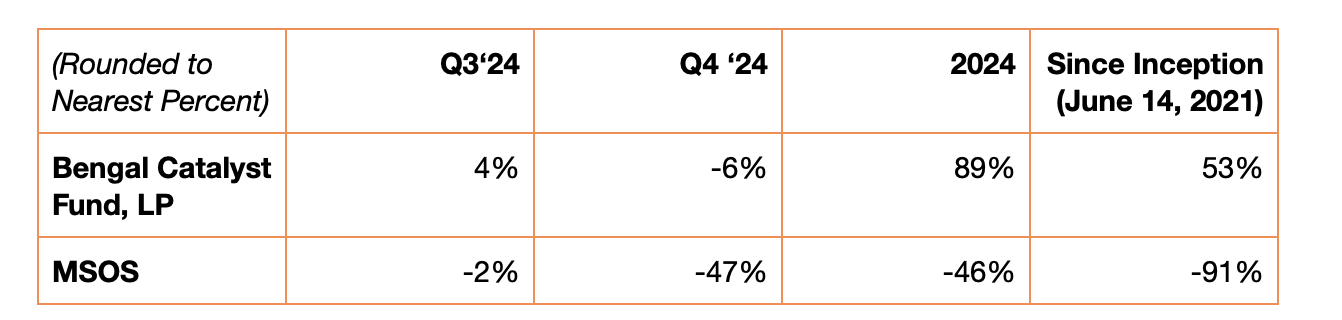

The Bengal Catalyst Fund, LP’s (the “Fund”) performance (preliminary estimates, net of fees, and unaudited) is presented below alongside that of MSOS, a US cannabis-focused ETF. We do not consider MSOS a benchmark but rather a reasonable indicator of US cannabis investor sentiment.

*Note that the above figures net out our current estimate of incentive allocation for the period. The final numbers may be slightly different from what we estimate, but hopefully not materially so.

Our proviso above that MSOS is not a Fund benchmark has only grown more salient as the Fund’s composition, which includes modest exposure to debt and preferred equity, is very different from the public equities contained in MSOS. Again, we include MSOS as a general indicator of sentiment and nothing more.

Despite being modestly down in the fourth quarter, the Fund performed well over the course of the year. We believe the Fund’s positions have a number of advantages over most MSO public equities as we discuss in our commentary below.

A few reminders:

Your results may vary from those above depending on time of investment

The above figures do not include the results of any side pockets

We expect our returns to be volatile given the illiquidity and concentration of the Fund’s portfolio. Regarding the last point, we fully expect that there will be periods in which we underperform the broader cannabis equity market as we seek to generate sustainably better longer-term returns.

Your individual account statements should be available soon at the Panoptic investor portal. Please reach out to us if you need help accessing them.

As is our usual practice, we are sharing some thoughts regarding the cannabis investment environment below. Please feel free to share with others.

Bengal Commentary - Q4/YE 2024

Fundamental Shorts

“The tale of the tape is grim” is how we started our 2022 Fund letter, published on February 6, 2023. On that day, MSOS closed at $6.96. As of today, MSOS is trading at $3.24 - right around its all time low. So, the tale of the tape is grimmer.

Why have cannabis stocks fallen so much? Lack of political reform, predatory algorithmic trading on illiquid exchanges, unregulated hemp products using a legal loophole to steal market share from regulated cannabis businesses - the list of usual suspects goes on. It could be all or none of the above - no one really knows.

We are constantly looking at the opportunities presented in cannabis to try to find the best ones to put capital behind. So, instead of asking why cannabis stocks have fallen so much, we ask: “What are these stocks actually worth?” The answer we arrive at is that most large/medium MSOs, despite the seemingly consensus opinions within the cannabis investing community, are fundamentally overvalued. This doesn’t mean they won’t make a good trade, but rather reflects our view on their long-term cash flow trajectory, inclusive of varying scenarios of federal reform.

So, we move on to smaller publicly traded cannabis companies. Many of the smaller cannabis companies are in worse shape than the larger ones. Some smaller cannabis companies are definitely on our watch list, and we are waiting for either a future growth trajectory to be more crystalized in our minds, or for the valuation to become even more compelling, or both. We originally set out to find companies like Grown Rogue, and we are now confident that similar companies are much more rare than we imagined when we started the fund over four years ago.

So where do we move on from there? To a private equity type strategy that takes advantage of what we feel is our unique place in the industry. The best situations for outsized returns we see in cannabis right now involve a right-sized opportunity needing a competent team and aligned capital. This is where compelling return opportunities continue to exist for our fund.

We elaborate on these thoughts below, and conclude with a Fund portfolio review.

A Brief Review on Why MSOs are Largely Bad Businesses

We have written extensively on the problems with MSOs before. An executive summary with some links is below:

In our 2022 YE Fund letter we wrote about how large MSOs attained their size by being prodigious raisers of capital rather than good operators, and how their competitive advantage amounted to “being early.” We also noted how cash generation had already started to come down as leverage had ticked up. Being early is the kind of competitive advantage that needs to be built on, but history shows that most MSOs largely just laid on it instead.

In Q1 2023 we wrote about how large MSOs were “underefficient” and had likely built large facilities utilizing expensive financing (often sale leasebacks) which would permanently hurt their cost structures - especially when compared to an efficient, scrappy operator like Grown Rogue.

In our 2023 YE Fund letter we explicitly called out typical MSOs for being bad companies and likened them to locusts that feasted on high cannabis prices before turning up stakes and leaving as the market became more competitive. We highlighted Curaleaf (TSX: $CURA, OTC: $CURLF) as an example of a company that has consistently failed to produce profits despite significant capital investments. We ballparked their “true” Q3 2023 adjusted EBITDA margin as around 19% versus its reported number of 23% - and consensus estimates from a year before in 2022 had predicted that Curaleaf’s 2023 EBITDA margin would be over 30%.

In Q1 2024 we noted how an increased focus on “verticality,” i.e. MSOs stacking their shelves with their own often subpar products, would lead to a very real but hard to immediately see in the financials’ phenomena: customers leaving to go to stores that give them the choice to buy what they want.

In Q3 2024 we talked about how assuming a “reversion to the mean” for MSO profits was like assuming that a journeyman shooting guard would start to revert to Steph Curry’s three point accuracy.

We think we were, and continue to be, largely right in our criticisms.

Setting the Table - Where Multiples and Value Come From

We are fundamentals-focused investors first and foremost. We do our best to try to figure out what future profits a company will make. This is no simple task for emerging industries, let alone those with complex regulatory environments, but this is the puzzle we enjoy. This breaks down into a few things: what kinds of profits a company has and will make from its previous investments (i.e., its record of capital allocation to date), what opportunities the company has to invest capital to produce more profits in the future, and what the returns on those incremental opportunities will be.

In common parlance, a lot of this kind of analysis is embedded in discussing what “multiple” a company deserves to trade at. Based on fundamentals, companies get high multiples when they are expected to make high profits in the future (“high growth”), or there is a high certainty to the profits they will make (e.g., a very stable profit consumer staples company like a french fry maker), or some combination of both. Large MSOs have neither - and medium size MSOs are pretty much all slightly smaller versions of the large behemoths with no redeeming qualities and often worse balance sheets.

Large and Medium MSOs Are Overvalued

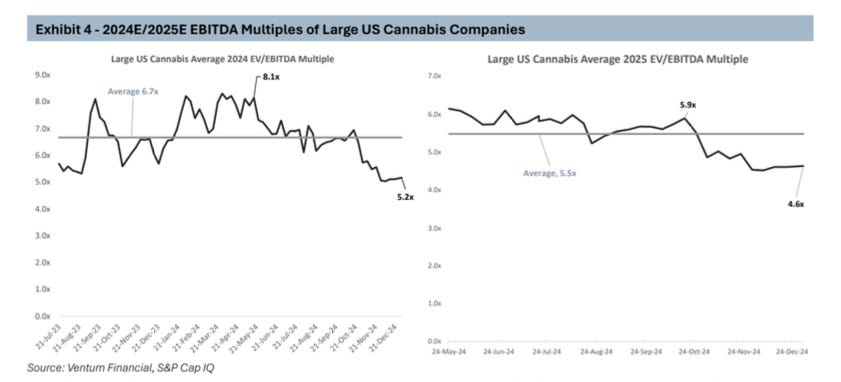

Cannabis investors have frequently kvetched about cannabis companies generating significant adjusted EBITDA (a number which we think is next to useless for cannabis companies) while the multiple the market is assigning those “earnings” continues to contract. Indeed, this has happened - much of the retreat of cannabis stocks can be explained by significantly lowered multiples:

Investors seem to see lowered multiples and equate it to undervaluation. But, based on fundamentals, this retreat is deserved.

Why? Well, first let’s take a look at one of the most basic questions when it comes to what future multiple a company deserves: how has a company done relative to its projections in the past? The answer is, frankly, a bit embarrassing for MSOs.

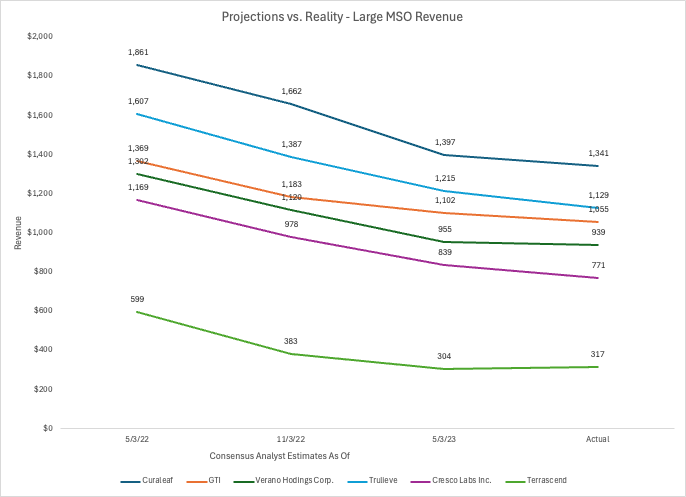

MSOs - Terrible in Forecasting Their Own Businesses

The charts below show consensus analyst estimates for revenue and aEBITDA and how those estimates moved over time for some of the largest US cannabis companies: Curaleaf (TSX: CURA, OTC: CURLF), GTI (CSE: $GTII, OTC: $GTBIF), Verano (CSE: $VRNO, OTC: $VRNOF), Trulieve (CSE: $TRUL, OTC: $TCNNF), Cresco (CSE: $CL, OTC: $CRLBF), and Terrascend (TSX: $TSND, OTC: $TSNDF).

To the uninitiated, we should also be clear that analyst estimates, especially in cannabis, often function as a form of unofficial guidance - the numbers analysts come up with are often back channeled with the company to make sure there is not too much of a difference between the analysts’ forecasts and companies’ to avoid embarrassment when an analyst puts out a wildly optimistic or pessimistic note. So, the failure to properly forecast a business is not just on the analyst - this indicates something about the companies themselves as well.

With that in mind, May 2022 consensus analyst predictions were that Curaleaf would have 2023 revenues of ~$1.9 billion. Actual 2023 revenues were ~$1.3 billion - off by about a third. When combined, these top six MSOs were expected to do ~$7.9 billion in revenue and only ended up doing ~$5.6 billion - again, a miss of about a third. The “best” company, GTI, only missed its 2023 revenue estimates by 23%. Terrascend, the “worst,” missed by almost half ($599 million forecast vs. $317 million actual).

(Source: May 2023 Capital IQ and Thomson Eikon Data)

For aEBITDA predictions, the case is worse. Curaleaf was originally forecast to make $562 million in aEBITDA but only reported $305 million - a difference of almost half. The top six were forecast to do ~$2.8 billion in 2023 aEBITDA and ultimately only put up $1.5 billion - again, a difference of almost half. GTI, again the “best” in this comparison, was originally forecast to make $478 million in aEBITDA and reported $326 million - a miss of “only” 32%. The worst misses, easily seen below, were by more than half.

(Source: May 2023 Capital IQ and Thomson Eikon Data)

Our belief is that internally generated cash flow, if normalized for being a taxpayer, likely missed these internal projections by substantially more than their aEBITDA (“adjusted” earnings before interest, taxes, depreciation, and amortization) miss would indicate. In many industries, aEBITDA is “fuzzy,” but at least has some discernible relationship with operational and/or free cash flows - i.e., a company will reliably convert 60-70% of its aEBITDA number to cashflows. Among the top six cannabis companies, with the exception of GTI, aEBITDA has not had a reliable relationship with generated cashflows - and this has only become more true since all but GTI started to generate cash through nonpayment of “280E taxes.”

Analyst estimates crashed down to Earth over time. By May 2023, after both the analysts and MSOs had seen significant trajectory in how 2023 was actually developing, estimates were much lower than they had been a year before - but, even then, analysts’ consensus aEBITDA projections sometimes missed by 10%.

In May 2023 analysts were also predicting how these companies would do in 2024. How are those predictions fairing? Often not particularly well, as the chart below shows. Trulieve, which looks like it is doing “better” relative to its estimates, is reaping the benefit of capital investment that lowered its Florida costs - but the long term return on this capital investment is a question mark (as we discuss more below in the Florida section) - and because aEBITDA allows Trulieve to adjust out its >$100m in political spending on Florida’s failed adult use initiative.

(Source: May 2023 consensus estimates from Capital IQ/Thomas Eikon data, February 2025 consensus estimates from Stoic Advisory 2/21/25 update)

Why The Forecasts Are Historically Terrible

Why did this happen? Some might say that the estimates were missed because certain states had much worse adult use rollouts than anticipated (e.g., New York) or had unanticipated political developments that stopped adult use in its tracks altogether (e.g., Virginia). But, even if this is the case (and often analyst estimates exclude political developments like anticipated Florida adult use sales even when passage of Florida’s adult use constitutional amendment looked likely), that just means everyone missed a fundamental risk of doing business in cannabis.

Adult use rollouts vary. Places like New York clearly had political crosswinds developing that could have slowed down MSO sales. Ohio is potentially having a slower ramp up than it could have due to state advertising restrictions on adult use retailers. Delays, be they speedbumps or dead stops, are a basic cannabis risk we have seen before many times - and will likely see again.

The other, more significant in our minds, reason the estimates were off so much is because people consistently under estimate the speed and force of price compression, what we often refer to as normalization, in maturing markets. Analyst, and company, models often have a nice linear progression of price compression like 1% decline per month, but in the real world we see it happens quite differently - ~40% over 2023 and 2024 in New Jersey, 40% in a year a few years ago in Massachusetts, 10-25% (depending on who is doing the counting) in just Q4 2023 in Florida, and the list goes on.

So, in light of the historical inaccuracy and the increasing price normalization we are seeing in many markets, we are skeptical when we look at current consensus estimates for 2026 EBITDA and see that analysts have conveniently forecast increases from 2024 for all the top six MSOs with the exception of Cresco:

Price compression in many markets is not done and, for some like Florida which we discuss below, things will likely get much worse before they get better. Management often wishfully anticipates that price compression will “level out” at some point later in 2025. Given their track record of predictions, investors should be very skeptical.

Taking a step back, the largest five cannabis companies are now predicted to generate about ~$1.8B in EBITDA in 2026 while in 2022 these same six companies were predicted to generate ~$2.8B in EBITDA in 2023. Low multiples are more than justified here.

Even Analysts Are Now Starting to Note Core Problems

Even industry analysts, who are largely pre-disposed to be very friendly to the industry so as not to risk investment banking relationships and profits, are starting to call out major industry profit stressors.

Like price compression:

And rapidly increasing competition in previously oligopoly markets:

Some have commented on the New Jersey price compression over the last few years as “undeniably surprising”:

To echo mixed martial artist Nate Diaz: We’re not surprised.

The Failure of Florida Adult Use Accelerates The Decline

We suspect that Florida is an outsized producer of cash for some of the larger MSOs. This is easiest to see in Trulieve’s numbers, is fairly clear in Verano’s, and we strongly suspect is also where a decent slug of Curaleaf’s operating cashflows come from - not to mention some of the second tier players like Ayr and Cansortium.

So, price compression in Florida is especially painful to these companies - and as the image above and below show, price compression in Florida in 2023 was significant:

We have always voiced skepticism on how much SAFE, Schedule 3 and other current federal potentialities actually affect underlying business fundamentals. Not so with state-level reforms, which are often strong catalysts to bigger markets and, at least temporarily, increased profits.

Ohio adult use was a welcome development, but for those MSOs that operate there, a state of 12 million people simply does not move the needle as much anymore given the size of the rest of their business. Not so with Florida, a state of almost 23 million that promised a significant, if temporary, bump in cash flows. With cash flows suffering in their other states and now being stressed in Florida, that initial adult-use gravy train was something these companies were eagerly anticipating.

In that anticipation, many Florida players increased capacity to be better able to serve a much larger market - Verano alone reported that most of its $85m in 2024 capex so far was invested in Florida, Ayr recently inked a deal with IIPR to fund a new $30m, 98k square foot production facility, and some smaller private companies also reported expanding.

But Florida adult use failed. Patient growth restarted, but even the most optimistic predictions we have seen put patient count at just over 1 million by the end of 2026. Adult use would have likely created a market of over 3 million.

Now all of that capacity, and increased store count, is chasing a much smaller than anticipated set of customers. Putting it all together, you have a state with: already intensifying price competition, with relatively modest customer growth, but much faster capacity and store growth. Even if it takes a few quarters to fully develop, this is a recipe for even faster price, and cash flow declines - with enough capital and capacity, even “limited license” states like Florida become a knife fight.

Some executives deserve credit for being up front about this coming storm. Robert Beasley, CEO of Fluent Cannabis (formerly Canstortium) (CSE: $TIUM), which operates 35 dispensaries and over 150k square feet of cultivation space in Florida was explicit in what he predicted would happen in Florida:

What I anticipate to occur next is a scenario where the amount of production that has been contemplated is still going to proceed. And so therefore, it’s going to cause an increase of overall material available in the market. Now what does that do, of course, is it probably will lead to price compression.

…

But we do expect a period that’s good for the consumer, but going to be very tough for the competition in Florida as all of this canopy space, this availability, gets put into the market.

(Source: Fluent Q3 2024 Earnings Call)

Mr. Beasley’s later prediction, however, that “[i]t’s going to be a knife fight for two quarters or maybe three. And then it will stabilize as this excess capacity gets wasted through the system,” is wildly optimistic. Numerous other markets have shown that these overcapacity/price compression scenarios last much longer than a few quarters.

And it all couldn’t come at a worse time.

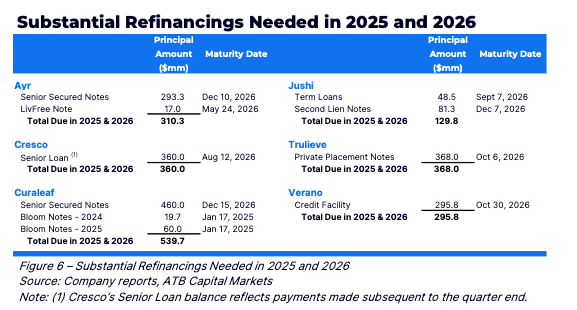

Debt Maturities Loom

So, let’s review the situation for Trulieve, Curaleaf, and Verano: their plum market of Florida is going to get a lot more competitive while their other markets are also worsening (or not making much of a difference like Ohio) - right as they run into major debt refinancings. Combined, these three companies have over $1.1B in debt due in 2026 that will need to be refinanced. Refinancings take time, and they will start shopping these refinancings soon - right as we anticipate Florida continues to deteriorate and pull down their financial results.

All of these things combined point to higher debt costs, not lower. Companies that are able to convince current debt holders to extend will likely pay significant concessions to do so - higher rates, warrants, etc. Companies that refinance can expect significantly higher debt costs than a few years ago, when major MSOs were inking sub 10% coupon debt without major warrants or other sweeteners.

And the situation is even more dangerous for companies like Ayr if they cannot convince their current debt holders to extend. They may find that there is not much demand left among debt providers to refinance them after the higher quality companies have been filled.

In situations like this, it is equity that bears the brunt of the risk. Pharmacann provides a glimpse of the future.

Pharmacann: The (Zombie) Canary In the Coal Mine

Pharmacann, a large private MSO and IIPR’s largest tenant, recently defaulted on all of its IIPR leases before reaching a tentative settlement with IIPR. We say tentative because the press release disclosed that the settlement with IIPR is contingent on the extension/refinancing of Pharmcann’s senior debt due this year, which has not yet occurred to the best of our knowledge (they are private after all).

Investors mostly looked at this sequence of events to determine what it meant for IIPR, but they missed some other serious implications for the cannabis business:

Pharmacann is relinquishing its Michigan facility - a 205k square foot, $84m facility that common MSO “economy of scale” wisdom should have been able to crush Grown Rogue’s substantially smaller and less expensive facility in competitiveness. Instead, Pharmacann could not make the economics work. Neither could Parallel in Pennsylvania. In fact we can’t see a world where this doesn’t happen to many other public MSOs. Things like Trulieve closing its IIPR-funded, ~$44m Massachusetts facility often get overlooked because of the surplus profits they’re generating elsewhere.

IIPR required Pharmacann investors to inject additional equity as a condition of even the tentative deal - i.e., before the senior debt refinancing was completed. Investors can be sure that this was a down round compared to previous Pharmcann equity raises.

We have significant experience negotiating with IIPR, and it’s our belief that meaningful lease restructurings only come with substantial pain to the legacy equity holders, and sometimes lenders as well.

While Pharmacann may be a more extreme situation than that faced by Trulieve, Curaleaf, and Verano, the principle remains: equity is last in line and will bear the brunt of a company’s failure to perform.

In short, investors should not trust management that say otherwise like then-Cannabist CEO Nicolas Vita, who said on Cannabist’s Q2 2023 earnings call:

We have inherited a couple of pretty sort of punitive sale leasebacks from acquisitions, and those are not at market rates. I think that Derek [indiscernible], but our best guess is that those sale leasebacks are somewhere north of 300 to 500 basis points ahead of where we would be paying if we had just traditional debt structures in place. And so that's, for us, we consider that low-hanging fruit and we've had conversations with IIPR about those. (emphasis added)

(Note: As this letter was being finalized, Cannabist announced a debt restructuring which has the support of 61% of its non-mortgage debt holders. As a carrot for extending, debt holders will receive 25% of Cannabist’s equity. Although current equity holders receive anti dilution warrants, it certainly appears that the costs to equity will be high. Cannabist has not yet reported any renegotiations with IIPR.)

If other MSOs had to raise equity now, how would they do? We can’t say for sure. But, at the very least, Curaleaf and Terrascend’s TSX uplisting equity raises provide guideposts. Curaleaf raised just over US$11 million in October 2023 and Terrascend raised around US$14 million in July 2023 at a time when their stock prices were roughly double of what they are today. These are relatively tiny amounts absolutely and relative to their enterprise values/outstanding debt obligations. Given the other forces at play, and, to us, indicate a significant lack of investor interest in providing equity cushions to overleveraged MSOs. Equity buyer beware.

The combination of lowered operating cash flows and refinancing needs is potent, but many seem to ignore this situation because they expect something like Schedule 3 to solve all of these problems. As these kinds of expectations have been for the last few years, this is misguided. With the performance in the sector, it’s arguable that much of this pain is reflected in the equities, yet we don’t see meaningful relief for the fundamentals or equity holders.

Schedule 3 Won’t Save These Companies

Schedule 3 hearings have now been called off in light of the litigation by Village Farms, so a reasonable timeline for Schedule 3 happening is next year, in our (loosely held) opinion. This despite the very online cannabis investor contingent desperately hoping that DOGE and/or President Trump use political capital to speed the process along - despite the fact that such meddling would almost certainly be a potential issue in future litigation and seemingly give opponents of Schedule 3 a fighting chance in court. So, whatever the timeline was for Schedule 3 at the end of 2024, it has likely been extended and 280E taxes remain likely to be on the books this year.

But, lo and behold, most large MSOs are not paying 280E taxes already. In accounting terms, this means that their cash flow from operations is increased by an income tax payable - i.e., the company gained cash by not paying taxes. The 280E taxes then get added onto the balance sheet as a liability under uncertain tax position. If 280E is eliminated, this last step won’t happen - there won’t be any more uncertain tax positions. But actual current cash flows will not increase for these companies- we believe investors are already seeing the ceiling of what MSO assets will produce in cash.

And the result is not impressive.

Hey Farva, what's the name of that restaurant you like with all the goofy shit on the walls and the mozzarella sticks?

Shenanigans.

For five of six major MSOs, unpaid 280E taxes are a major component of operating cash flows through the first nine months of 2024, showing investors a preview of what a world without 280E looks like. Not paying taxes makes the results look better but not spectacular enough to demand higher multiples - especially when all signs (like increasing price compression detailed above) point to lower cash flows in the future for all but GTI.

(Note: As this letter was being finalized, MSOs had begun reporting full year 2024 numbers. Trulieve reported $272m in operating cash flows, of which $265m were from nonpayment of taxes and/or previous years refunds received. GTI reported $195m in operating cash flows inclusive of paying $131m in taxes. Nothing we have seen so far in the 2024 reporting causes us to question the basic points made above based on Q2 2024 numbers.)

Memeness

Yeah, maybe Schedule 3 gets done this year and also SAFE Banking that allows uplisting and maybe Curaleaf uplists to NASDAQ and gets memestocked by HODLers and is a home run. But maybe not.

Fundamentally, large MSOs except GTI look like shorts - a history of bad investments that are producing middling cash flows now with those cash flows set to be decreasing in the future.

But, the argument goes, the lack of profitability and business quality doesn’t seem to hurt the ability of Tilray and Canopy Growth to raise money through their at the market (ATM) selling programs. Indeed, that’s the only reason these companies have survived. But how many cannabis meme stocks can get created? Do people really see a world where Robinhood traders are meme trading Curaleaf, Cresco, Terrascend, Trulieve, AND GTI?

And, if so, why not just own GTI? Wide market exposure, way better balance sheet and operating performance, and likely exposure to all of the potential meme stock madness as the others.

So Where Does That Leave Us?

So, the large cannabis companies are largely uninvestable. The medium-sized cannabis companies are largely worse - Cannabist, Jushi, and Ayr stick out as structurally unprofitable companies with deeply impaired (read: worthless) equity. So we look to the even smaller cannabis companies to try to find a second Grown Rogue-like story - a scrappy operator at a compelling price relative to current profits and likely growth.

Easier said than done. Some smaller companies that we once were intrigued by, such as Marimed, made strategic mistakes and now just look like large MSO also-rans, perhaps with a better growth trajectory given the last two years of capital investments. Other small cannabis companies that have managed to be cash generators are on our watch list for when they become compellingly undervalued - recall that the Fund started to purchase Grown Rogue stock at or below CAD$0.10 per share.

Private Equity

We believe Bengal’s team often sits at a nexus between great opportunities, reliable/trustworthy teams, and capital. While seemingly everyone else is trying to build the next Diageo, we are just looking to continue to play private small ball: a reasonably-sized cultivation opportunity combined with a solid, battle-tested growing team, in a market begging for reasonably priced, quality product - all enabled by Bengal capital. Over time, we anticipate larger opportunities will emerge.

Portfolio Review

As of this writing, the Fund’s portfolio contains securities from three companies:

Grown Rogue (CSE: $GRIN, OTC: $GRUSF): Common stock.

LadderRe (Private): Preferred stock

Body and Mind (CSE: $BAMM, OTC: $BMMJ): Common stock, secured term debt, and secured convertible debt.

Grown Rogue

Practicing what we preach on leaning in, Bengal partner Josh Rosen is now Chief Strategy Officer of Grown Rogue. His focus will be on capital allocation and business development, which should leave CEO Obie Strickler doing what he loves and does best: standing up great new craft cultivation operations.

Grown Rogue now has operations in Oregon, Michigan, and New Jersey. Illinois is on pace to start construction this year and be operational next although, consistent with Grown Rogue’s philosophy, meaningful construction won’t start until the project is fully financed. What Grown Rogue is worth is inextricably tied to what future opportunities investors see beyond these four states. We believe that this is just the start of Grown Rogue’s growth - and that Grown Rogue’s future growth may look very different from its past growth as increasing distress in many previously competitive states leaves opportunities for Grown Rogue to take over cultivation facilities and only needing to deploy a fraction of the new capital it took, for example, to stand up New Jersey operations.

To some in the industry, it seems absurd to buy Grown Rogue at what looks like 18x run-rate EBITDA when you can buy Trulieve for closer to 3x. But, to us the choice couldn’t be clearer because of the underlying compounding of value taking place at Grown Rogue.

Vireo

As of the publishing of this letter, the Fund has liquidated its position in Vireo (CSE: $VREO, OTC: $VREOF). Vireo is in the midst of a transformational series of deals that included raising a significant amount of equity at a premium to then-market (a task we think basically impossible for any other MSO or almost any other public company) along with rolling in a number of modest-sized single-state operators in other states. The end result should be a much larger MSO with a stronger balance sheet than almost all of its peers and what we believe remains a compelling litigation asset.

Why did we sell? A few reasons:

We wanted fresh capital to lean into our private equity type strategy, and be ready for those opportunities as they arose.

While it instantly has a better balance sheet and numerous capital advantages, Vireo’s impending rollup suffers from the exact same kinds of execution risk as other failed cannabis rollups of the past.

As common shareholders, we had a dim view of some of the compensation provisions which new management was able to negotiate.

LadderRe

For the startup cannabis insurance business we helped stand up in 2024, signing the initial deals has taken longer than anticipated. The modestly slow start is somewhat balanced by the terms on its initial agreements being more favorable than expected. It is still very early, but we remain excited about the potential returns in this incredibly small niche of specialty reinsurance.

Body and Mind (BaM)

Initially an equity investor, the Fund’s holdings are now almost all composed of either term debt or convertible debt. Since, in our capacity as debt holders, we could be privy to confidential information, we have to keep our comments general. Also note that Josh Rosen has left the board of BaM to focus on his new role at Grown Rogue.

The most important recent development at BaM is its agreement to divest its Illinois assets for cash consideration of $5m, with an earnout based on EBITDA performance. We expect, per the applicable debt covenants, that the majority of consideration received through the Illinois divestment and the remaining consideration for a previous Ohio divestiture sufficiently covers our outstanding principal and interest balances

Conclusion

The vast majority of this letter is about stocks we do not own - why is that? Because to understand why we pass on Trulieve at 3x EBITDA to own and support Grown Rogue at a seemingly much higher valuation, we need to explain why we question the long term equity value of Trulieve and others like it. Especially when we see a confluence of factors (Florida capacity buildup prior to adult use failure and looming debt maturities) that makes the near-term future look much worse.

We anticipate that we will gradually write less about the larger MSOs since we have mostly said our piece and now events will either play out like we think or not. In the future we expect to write more about what truly excites us in the industry: the opportunity to bring together new “private equity” style projects while continuing to help Grown Rogue build value in new markets.

-

Should you wish to respond to this letter or discuss anything within it, please reach out to Bengal partner Jerry Derevyanny at jerry@bengalcap.com. We are always happy to thoughtfully engage with those that agree and disagree with us.

Disclaimer

The information contained in this letter is provided for informational purposes only, is not complete, and does not contain certain material information about our Fund, including important disclosures relating to the risks, fees, expenses, liquidity restrictions and other terms of investing, and is subject to change without notice. This letter is not a recommendation to buy or sell any securities.The information contained herein does not take into account the particular investment objective or financial or other circumstances of any individual investor. An investment in our fund is suitable only for qualified investors that fully understand the risks of such an investment after reviewing the relevant private placement memorandum (“PPM”). Bengal Impact Partners, LLC (“Bengal Capital” or “we”) is not acting as an investment adviser or otherwise making any recommendation as to an investor’s decision to invest in our funds.

Perhaps most importantly, Bengal Capital has no obligation to update any information provided here in the future, including if any positions discussed are sold or purchased, or if different positions are purchased.This document does not constitute an offer of investment advisory services by Bengal Capital, nor an offering of limited partnership interests of our Fund; any such offering will be made solely pursuant to the Fund’s PPM. An investment in our Fund will be subject to a variety of risks (which are described in the Fund’s definitive PPM), and there can be no assurance that the Fund’s investment objective will be met or that the fund will achieve results comparable to those described in this letter, or that the fund will make any profit or will be able to avoid incurring losses. As with any investment vehicle, past performance cannot assure any level of future results.We make no representations or guarantees with respect to the accuracy or completeness of third party data used or mentioned in this letter. We provide services, such as strategic consulting services, to certain entities mentioned in this letter and may in the future provide such services to more in the future, or to companies not mentioned in this letter. While we may sometimes advise on issues regarding corporate communications, we do not believe any of the services which we provide are “stock promotion” - we have not been and will not be compensated for the mention or discussion of any of the companies discussed herein. We disclose such arrangements to investors in the Fund and will continue to do so.

What are your thoughts on Glass House?