The following letter was recently sent to investors in our Fund.

Dear Investor,

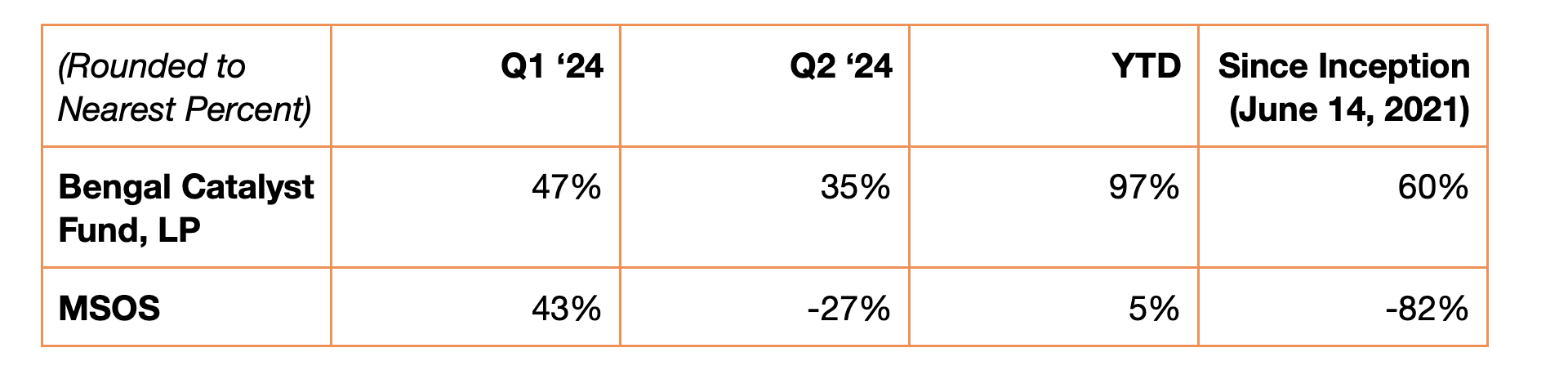

The Bengal Catalyst Fund, LP’s (the “Fund”) performance (preliminary estimates, net of fees, and unaudited) is presented below alongside that of MSOS, a US cannabis-focused ETF. We do not consider MSOS a benchmark, but we do believe it is the closest equity market proxy for the US cannabis industry, so we view it as a reasonable indicator of cannabis investor sentiment.

*Note that the above figures net out our current estimate of incentive allocation for the period. The final numbers may be slightly different from what we estimate, but hopefully not materially so.

The Fund continued its strong start through the first half of the year. The Fund is now also outpacing the S&P 500 since inception by a significant margin.

A few reminders:

Your results may vary from those above depending on time of investment

The above figures do not include the results of any side pockets

We expect our returns to be volatile given the illiquidity and concentration of the Fund’s portfolio. Regarding the last point, we fully expect that there will be periods in which we underperform the broader cannabis equity market as we seek to generate sustainably better longer term returns.

Your individual account statements should be available soon at the current fund administrator’s (Panoptic) investor portal. Please reach out to us if you need help accessing them.

As is our usual practice, we are sharing some thoughts regarding the cannabis investment environment below as well.

Bengal Commentary - Q2 2024

Rethinking “High Growth”

Portfolio Review

The Fund continues to hold the same companies as it did in Q1: Grown Rogue, XS Financial (XSF), Goodness Growth, and Body and Mind (BaM). Some brief updates regarding those companies and our views on them are below.

Grown Rogue

The Fund sold two million shares (of a total of over 23 million) of Grown Rogue stock for CAD$0.92/~US$0.67 towards the end of Q2 in order to generate liquidity. The buyer was a swap provider to MSOS, and it enabled MSOS to effectively take a larger position in Grown Rogue stock. A short while after the quarter ended, we sold an additional 700k block of shares to an existing Grown Rogue shareholder as well.

Lest investors, or others, think that this block sale demonstrates some kind of backing away from our conviction that Grown Rogue remains undervalued with a long runway of growth to come, we matched our block sale with a conversion of the vast majority of the Fund’s remaining Grown Rogue holdings (~21.4 million shares) into non-tradeable multiple voting stock in order to help the company retain its foreign private issuer status to avoid what are typically more costly audits and securities disclosure requirements. We continue to strongly believe that Grown Rogue’s best days are in front of it, and it was a no brainer for us to trade marginally higher illiquidity in our position in exchange for the company having more cash to deploy into its business in the near term.

Given that Grown Rogue is up so much from our purchase price, there is a very human urge to sell. How can something you bought below ten cents not be fully valued when it’s trading at over sixty cents now? Quite easily actually - when it continues to compound underlying value so much that even sixty cents is still cheap for what you are buying.

A common throughline appears in interviews with many great investors when asked what their greatest mistake was. Invariably, the mistake was selling too early while telling themselves “you never go broke taking a profit.” We will return to this in a Bengal Bite soon, but we continue to think that Grown Rogue is materially undervalued despite it now often sitting at the top of comp tables in terms of revenue or EBITDA multiples.

XS Financial

The Fund’s investments in XSF were split roughly equally between two categories of investment: convertible debt and equity (technically, some of the Fund’s holdings are in non-tradeable proportionate shares and some are in traded subordinate shares but that is irrelevant to the discussion that follows).

Our thesis on XSF from the start was that they had a good lending business which was run by great management that was transparent and that we trusted, structurally advantaged while being more flexible than larger REIT-style lenders, but still providing a lending product in sore need for the industry. We thought there was significant upside in the business but that the core competency in lending and underwriting would protect our downside. We turned out to be half right, mostly with respect to XSF’s solid underwriting capabilities and the manner in which even the deteriorating credits performed within their lending book.

What were we wrong about? We felt there was a good possibility of an ongoing cannabis “capital markets winter,” but we failed to appreciate just how bad the follow on effects would be, both with respect to the demand for XSF’s capital and XSF’s access to more attractive capital itself. As MSOs’ capital availability went down while capital costs went up, they had to limit capex spending - which, in turn, lowers demand for XSF’s financial products since they are used as an adjunct to larger capex financing provided by others like REITs, etc. As the capital markets closed to XSF as they had to MSOs, XSF was therefore forced to pursue a strategic transaction.

Recently, XSF announced a definitive agreement to take the company private at a bid of CAD$0.05265 per share. Assuming this transaction closes, we will suffer a significant loss on our equity position - somewhere around -54%. However, XSF recently paid back all of its convertible debt at par with accrued interest, and the Fund has been collecting interest in the interim as well. So, combined, our investment in XSF generated a loss of around -20%.

We turned out to be right on our assessment of downside protection, but that is cold comfort. The primary lesson learned for us here is to be even more wary of exposure to the animal spirits of capital markets than we had been in the past. That said, we still think highly of XSF’s management - they sailed their ship pretty well through some tough winds. We expect the XSF take-private transaction to close within 90 days of its announcement on June 24, 2024.

Goodness Growth

We are always careful with what we say about Goodness Growth because Bengal partner Josh Rosen is CEO and because Goodness continues to litigate with Verano over their busted merger, so please do not take our lack of commentary as lack of conviction.

On the business, we continue to believe Goodness has one of the best risk/reward profiles in cannabis. We believe that operations are improving and that Minnesota’s impending launch of adult use bodes well for both of the current licensed medical operators in that state - Goodness and GTI. Maryland continues to chug along well with its relatively recent adult conversion, and we are confident that Goodness and its primary lender, Chicago Atlantic, will come to an agreement on a longer-term debt extension soon. On the last point, Goodness recently sold some equity to Chicago Atlantic as part of capitalizing a new store build - not a large amount by any means, but something that simply wouldn’t make sense to do unless Chicago Atlantic was aligned as to the opportunity that Goodness represents.

Public perception of the Goodness/Verano litigation suffers from the same types of problems as many things in our little niche do. One of the main culprits is investors treating their investments as beloved childhood sports teams to be adored to the point where no flaws or failings can be acknowledged rather than as businesses to be rationally analyzed. One of the other culprits is equity analysts at the smaller investment banks that still do business with MSOs not having the wherewithal to be honest about the risks to Verano for fear of losing potential investment banking relationships. There are many more. As Josh has publicly noted, the only analysts which reached out to Goodness for more information regarding its claims to make a more accurate assessment of the situation are now-independent former bulge bracket bank equity analysts - none of the other current sell side analysts for Verano have.

Litigation costs, in this type of situation, are roughly equivalent to interest - and, given where cannabis costs of capital are, paying a few million in legal fees for a few years to kick the can down the road can be much cheaper than to borrow the money you need to settle the claim and then paying interest on that borrowed money. This is all economically rational - what is not rational, in our minds, is that Verano investors do not seem to even acknowledge the significant likelihood that, whether this year or in a few years, Verano will owe an amount to Goodness that they cannot easily pull off their balance sheet. We continue to like being on the Goodness side of the fight and believe that both the litigation and business have significant upside ahead.

Body and Mind

We continue to help BaM navigate a challenging time as strategic advisors and hope to have an update on our and the company’s efforts by next quarter.

Post Quarter End - New Investment

After the quarter ended, the Fund committed to purchasing the preferred equity of a privately held reinsurance operation focused on cannabis. As cannabis specialists focusing on opportunities that others ignore (often chasing size instead of quality), the reinsurance opportunity checked a lot of boxes for us: (1) quality, aligned management that we have either worked alongside or known for years in the industry and think highly of (disclosure: Bengal partner Josh Rosen is a founder of the reinsurance company, but has a more strategic role - i.e., we aren’t patting ourselves on the back and are actually talking about the managers that are in day to day control of the operation when we say “quality management”); (2) an ignored, niche opportunity with compelling returns but not large enough yet to have significant attention from larger capital providers/investors; and (3) compelling personal experiences about the profitability of insurance in the cannabis industry from our time in operating cannabis companies.

Earlier in the cannabis investing lifecycle, one of the “hot” types of stories was the cannabis “picks and shovels” story. Investors often seemed to overlook that what made the picks and shovels sales to prospectors so lucrative was that the prospectors needed the equipment and did not have any way of buying it directly themselves. But, large MSOs often go direct to China or elsewhere for materials they need, so the value of cannabis picks and shovels businesses always seemed to rest on a metaphor that did not quite work. Ironically, cannabis insurance is the closest to a true picks and shovels business we have seen in the sector. Much like Dwight Shrute being able to do many things himself but not being able to pulverize his own kidney stones without the help of a nephrologist, cannabis companies are very rarely not going to need some kind of help with insurance.

The company continues to raise a modest amount of money in preferred equity. To those investors interested, we are happy to make an introduction to management to let them get more information - please email us and we will get it set up. To be clear, this is not something we are “selling,” and we do not plan to take any fees for introductions, investment, etc. - we like this opportunity and invested behind it, it could do with some more money, so we are sharing it - that simple.

Cannabis is Not Really “High Growth”

Sacreligous to utter, we know. But “high growth” usually is used to mean a specific kind of growth in a specific kind of market - one that cannabis markets do not bear much resemblance to. Usually you see this phrase used in tech to mean a market (TAM) with a potentially quite high but as yet unknown ceiling - when Facebook started, it was an open question how many grandmas in Vietnam would use the service but there was a chance all of them would (and, in fact, pretty much all of them now do). Cannabis is functionally the opposite.

The illicit market for cannabis has been serving customers for decades - cannabis is not a “new” market by any means. Additionally, we actually have fairly good data on how many people are users of cannabis (~10-15% of the adult population use monthly or more depending on region in the US) and how fast the number of users is growing (7% per year is often thrown around but this number likely overestimates a bit).

Even more, we now have a decade of data from mature adult-use regulated markets that provide pretty strong evidence on many fundamentals of market sizing - including how much populations spend per capita on cannabis products yearly (e.g., Washington state spending including excise tax is roughly $200 per capita per year). So cannabis is very different from most “high growth” industries because we have solid information on where the ceiling is.

So, the rapid growth of the regulated market is not rapid growth of the cannabis market - it is just the regulated market taking share from the existing market. What masquerades as “high growth” in cannabis is actually rapid absorption.

Rapid Absorption and Investor Instincts

As humans, we use mental models we are familiar with to describe the present and predict the future. The rapid absorption dynamic seems to throw off many investors’ instincts - their first urge is still to base future growth off of today’s growth without ever doing a gut check to see if their estimate for future growth is realistic in light of the market’s likely total underlying demand.

As we have written about before, the “high growth”/actual rapid absorption of illicit markets by regulated cannabis markets has a consistent basic underlying pattern: increased units with decreased prices. Unlike many classic “high growth” markets, this makes success in cannabis much more sensitive to initial underlying profitability. In a typical high growth tech market, it is possible that a “rising tide lifts all boats,” but that is exactly the wrong kind of heuristic to use for cannabis. The basic calculus of this absorption does not change when a new state comes online - it just introduces a new market where the absorption dynamic will play out over time.

Put simply, given the unit/price dynamics at play, an MSO that is not doing well in a smaller $500 million cannabis market (i.e., low number of units but higher prices) is going to do much worse in a much bigger $5 billion market (i.e., high number of units at much lower prices). High growth will not save them; rapid absorption will sink them. The inability to reliably make money in markets with even slight price normalization is one of the main reasons why we are skeptical of many large MSOs - no “growth” in new markets will reliably save these companies.

Some investor reactions to a recent gambit by GTI to potentially merge with Boston Beer Co., the ~ $3.6 billion craft brewing behemoth behind Sam Adams, illustrates where “high growth” mental models fall down.

A Concrete Example of “High Growth” Thinking Leading Investors Astray: GTI’s Merger Machinations

GTI made broader business headlines recently in its bid for Boston Beer, and the letter from GTI’s CEO Ben Kovler which was made public is worth a read. But, surprisingly to us, the news was not well received by many cannabis investors. Many cannabis investors were seemingly nonplussed - the most common objection seemed to (predictably) be that it was not a smart strategic move to combine a “high growth” company like GTI with a “low growth” company like Boston Beer - exactly the kind of situation where “high growth” thinking leads investors astray.

Let’s be up front and say that this is most likely a publicity stunt - the odds of a larger, more well-established company actually proceeding at risk of thumbing their nose at a large exchange, with accompanying noise from institutional investors, etc., are low. But, even if this is a publicity stunt, what is being proposed is fundamentally sound. One can imagine an irritated Ben Kovler looking at his Twitter feed and doing his best Scent of a Woman Al Pacino impression yelling “I’m givin’ ya pearls here” before going outside to have some Dogwalkers.

The industrial logic of the merger seems clear to us: take one consistently cash flowing alcohol business, combine it with a solidly cash flowing, responsibly run cannabis business with much more near-term growth but similar long term dynamics, with both businesses animated by the goal of delivering products that delight consumers, be they an alternative to Bud Light or a new cannabis strain, add in some responsible leverage and a serious buyback, and you have a potent cocktail for high returns on equity for years to come.

This is a cocktail the folks at SAM understand - $10k invested into SAM in 2009 would have returned about 16.4% per year and be $97k today while $10k invested in Anheuser Busch (BUD) would have returned about 6% per year with dividends and be worth only $24k today.

Again, even if this merger offer is a publicity stunt, many investors miss the logic of the proposal because of quick verbal shorthand (“high growth”) that inaccurately describes reality.

Motivated Reasoning

So why do investors seem to cling so strongly to characterizing cannabis as “high growth”? We think it is largely motivated reasoning - these investors think cannabis being perceived as high growth is necessary and sufficient for stock prices to go up.

Let’s make it real: If Large MSO X, which has a history of entering markets initially making money when units are low but pricing is high, and then making significantly less or losing money when units are high but prices are low, now enters the nascent Ohio adult use market - how much should the market value X’s new Ohio business given what we know about X’s business history?

The answer, on a fundamental basis, is not much if anything. So, what investors see as the market not acknowledging “catalysts” is, in fact, a justifiable lack of adjustment in a company’s present value based on the rational assessment that it simply will not make much more money in the long term. This brings us back to what we see as a simple fact: the fundamental value of many large MSOs do not justify higher values than where they trade today, and oftentimes point towards lower values. We have not seen anything that causes us to rethink what we previously wrote on the fundamental weaknesses of many large MSOs’ long term outlooks.

So, complaints about cannabis being an “inefficient market” miss the point in our minds - even if the market were efficient, the fundamentals do not point to major undervaluations in the majority of large MSOs.

Some investors seem to cling to “high growth” narratives as an article of faith because they realize that if these stocks are not “high growth,” the “structural” arguments for cannabis stock undervaluation also fall apart. Generally, proponents of the theory that large MSOs are generally undervalued use a combination of “high growth” and “structural” reasoning that is mutually supportive. Why is the market for cannabis stocks inefficient? Because of illegality, lack of custody, etc., meaning large institutions can’t own these stocks. Why would institutions want to own these stocks? These stocks are high growth! Therefore, the argument goes, as soon as structural issues are fixed, valuations will correct to where they rightfully should be. Take high growth out of the equation, and the structural undervaluation argument falls apart too - something many investors are not yet willing to accept.

…But Not Being “High Growth” is Not the Same as Being “Bad”

Some of those that read the above will conclude we think the cannabis market is bad. This is not the case, and could not be further from the truth. Cannabis actually enjoys some underappreciated benefits when compared to some “high growth” tech markets. Not least of which is that American society has clearly shown what the baseline demand for the product is, and mature markets show you how much consumers are willing to bankably spend. There is no need for cannabis companies to “prove” a market.

As we have written about before in our two Bites about cannabis as a consumer staple, we continue to believe that cannabis is an emergent consumer staple, although we believe that there will be vast differences in how well certain cannabis companies take advantage of this dynamic. For those well run companies that can make money in normalized price environments, total profit dollars (rather than percentages) stand to go up. For the other kind of company, restructurings and asset divestments will be their corporate long COVID. In the meantime, the better companies have a chance to establish durable market share leads.

Instead of focusing on high growth, we focus on the other, underappreciated, side of the fundamental valuation equation: how certain we are of future profits. That is the other, more slowly recognized by the markets, way for companies to get high multiples - but we think it is the most realistic way that some cannabis companies will eventually be rerated, leaving aside any temporary “trader” fluctuations and meme stock mania (which we have zero chance of forecasting like anyone else, whether they admit it or not).

We believe well run cannabis companies with solid underlying economics even in price normalized environments will start to demonstrate the consistency and reliability of future profits that is a hallmark of consumer staples. And, we think that cannabis is a consumer staple with a significantly stronger tailwind than most others, markets for which generally grow at approximately the same rate as GDP or population growth.

Conclusion

All of this points to what some cannabis investors have started to comment on: a bifurcation of cannabis stocks into high quality companies that can take advantage of the tailwind and others whose future is not quite so bright. Internally, we continue to be highly skeptical of cannabis as a “sector bet” because of the incredible variation in quality between companies. We believe that institutional investors will share our skepticism when the time comes.

All of these numbers on a screen, bar charts with squiggly lines, and tickers on Twitter prefaced with a “$” are not representations of cannabis generally but are pieces of individual businesses. These businesses will rise and fall based on their own merits, and we continue to look for the underappreciated future winners among them.

-

Please email Bengal partner Jerry Derevyanny at jerry@bengalcap.com if you want to respond to anything in this letter. We are always happy to thoughtfully engage with those that agree and disagree with us.

Disclaimer

The information contained in this letter is provided for informational purposes only, is not complete, and does not contain certain material information about our Fund, including important disclosures relating to the risks, fees, expenses, liquidity restrictions and other terms of investing, and is subject to change without notice. This letter is not a recommendation to buy or sell any securities.The information contained herein does not take into account the particular investment objective or financial or other circumstances of any individual investor. An investment in our fund is suitable only for qualified investors that fully understand the risks of such an investment after reviewing the relevant private placement memorandum (“PPM”). Bengal Impact Partners, LLC (“Bengal Capital” or “we”) is not acting as an investment adviser or otherwise making any recommendation as to an investor’s decision to invest in our funds.

Perhaps most importantly, Bengal Capital has no obligation to update any information provided here in the future, including if any positions discussed are sold or purchased, or if different positions are purchased.This document does not constitute an offer of investment advisory services by Bengal Capital, nor an offering of limited partnership interests of our Fund; any such offering will be made solely pursuant to the Fund’s PPM. An investment in our Fund will be subject to a variety of risks (which are described in the Fund’s definitive PPM), and there can be no assurance that the Fund’s investment objective will be met or that the fund will achieve results comparable to those described in this letter, or that the fund will make any profit or will be able to avoid incurring losses. As with any investment vehicle, past performance cannot assure any level of future results.We make no representations or guarantees with respect to the accuracy or completeness of third party data used or mentioned in this letter.

We provide services, such as strategic consulting services, to certain entities mentioned in this letter and may provide such services to more in the future, or to companies not mentioned in this letter. While we may sometimes advise on issues regarding corporate communications, we do not believe any of the services which we provide are “stock promotion” - we have not been and will not be compensated for the mention or discussion of any of the companies discussed herein. We disclose such arrangements to investors in the Fund and will continue to do so.

I really enjoy your letters and your rational long term cash flows based approach to evaluating this sector.

Pretty convenient you picked 09 to try and illustrate how good of a stock SAM has been. Did you calculate SAM’s return based on its absolute bottom after the GFC? Been a terrible investment for several years and I don’t see that changing based upon the secular decline in beer sales.